Highly leveraged Ott quietly cut his Orco stake

By: Anna Sieczkoś, 24. 11. 2008

Czech Business Weekly

Orco Property Group CEO Jean-François Ott lost his position as major shareholder after he sold

shares to repay loans. The most pressing question is whether Orco and Ott acted in shareholders’

interest by concealing information about the shares’ disposal while sending announcements blaming

short sellers for the price drops. Moreover, the secrecy may have violated notification rules.

Ott founded Orco 17 years ago and has built himself a reputation as a major figure in the Central

and Eastern European real estate market. The company currently holds over €3 billion (Kč 76

billion) of assets. “Since the IPO in 2001, he had been gradually decreasing his stake from 94 to

10 percent, however all the time retaining status of biggest shareholder and therefore decisive

influence on the company,” said Karel Potměšil, senior analyst at brokerage Cyrrus.

Ott’s dominant position in Orco seems to have ended after the stake held by Ott’s investment

vehicle Ott & Co was decreased to 1.6 percent on a compulsory sale due to Ott’s liquidity

problems. This makes Ott only the fourth-largest shareholder in Orco. According to Orco, the new

biggest shareholder of the company is now private equity fund European Investors with a 5.4 percent

stake. Bernard Gauthier and Jardenne Corp. hold 2.5 percent of shares each; the rest, some 88

percent, is in free float.

“Ott & Co is the vehicle through which I have invested in Orco Property Group. Given the

significant decline in Orco Property Group’s stock price, the bank that financed Ott & Co had to

sell the majority of Ott & Co’s shares in Orco Property Group as they were pledged as a

guarantee,” Ott said in a Nov.18 letter.

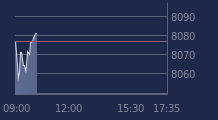

The news caused anxiety about the future of the company and effective control over Orco’s assets,

which led to a further decrease of Orco’s share price. During two trading sessions after the

announcement, it fell from €8.5 to €6.2 per share, which was a new historical low and means Orco

is traded at the 92.5 percent discount to June 2008 net-asset value (NAV).

“Due to the difficulty in reading the company’s true financial picture, and based on poor market

sentiment toward the stock and the real estate sector, we expect further pressure on the share

price. Regardless of the CEO’s pledges, we believe many investors will assume that the stake

reduction also reduces the management’s motivation to turn around the disastrous performance of

the shares,” said Igor Muller, analyst with brokerage Wood & Company Financial Services.

Share price debacle and desperate messages

At the beginning of September—after Orco released its financial results for the first half of

2008, which were positively received by analysts—investors and the share price seemed to have

stabilized at around €25 apiece. Patrick Vyroubal, equity analyst with brokerage Atlantik

finanční trhy is convinced that the compulsory liquidation of Ott & Co’s assets was one of

the reasons why Orco’s share price has fallen so much, despite solid half-year figures. “Other

reasons were sell-offs on world markets, negative sentiment toward the real-estate sector and short

positions of some investors,” Vyroubal said.

According to data published by Autorité de marché financiers (AMF), the capital market supervisory

body in France where the majority of Orco shares are listed, Ott’s stake was disposed of in two

rounds. In the first one, market was flooded with close to 5 percent of all Orco’s shares during

three consecutive sessions starting on Sept. 16. Under that pressure, share price tumbled 42 percent

to €14. The second portion, a 4.2 percent stake was offered to the market between Oct. 2 and Oct.

10, again sending the share price visibly down. On both occasions also the share price rebounded

strongly after the sell-off was over.

In the face of the information about change in shareholder structure, the announcements issued by

Orco during the disposal look extremely puzzling. First, on Sept. 17, the second day after Ott & Co

started to strongly sell shares, Orco issued a release trying to convince shareholders about the

firm’s strong liquidity, potential lack of which was the major risk for real estate developers. In

the second release issued Sept. 19, Orco blamed short sellers for the artificial depression of the

share price. Ott & Co’s shares constituted close to 50 percent of total trading volume in the

three-day sell-off period. Orco didn’t issue any similar messages, despite several other big drops

in the share price.

Potential breach of law

The information about the decrease of Ott’s stake in Orco was published by the AMF only on Nov.

17, close to a month after the last shares were sold to the market on Oct. 20. According to an

investor who contacted CBW about Orco and who is familiar with regulations of French capital market,

Ott & Co has breached AMF rules, which requires listed companies’ senior officers to declare their

transactions with company shares within five days of the conclusion.

The source added that Ott should have notified the company and market each time he transgressed the

threshold of 10 percent and 5 percent and 2.5 percent in the company. He instead did only this

cumulatively on Nov. 19. CBW requested explanation from Orco Property Group but did not receive a

response by press time. In any event, the minority shareholders, who held close to 80 percent of the

shares even before Ott & Co’s disposal, were for a long time deprived of essential information

concerning their company.

Despite that after the announcement about Orco’s new shareholder structure, the share price

suffered further blow, analysts say the news has no significant impact on the company’s

fundamental value. “However, without an agreement with other shareholders, via a 1.6 percent stake

Jean-François Ott will not be able to effectively control the company. It will be very difficult

for him to push through his proposals at general meetings of shareholders,” Vyroubal said.

Potměšil agreed that by now Ott’s stake wasn’t big enough for control, but he was the

strongest shareholder and his opinion was decisive. In the last several shareholder meetings, the

total number of shares represented ranged between 1.3 million and 1.6 million. Ott’s stake was

about 1.2 million shares.

Company craving for stability

Vyroubal pointed out that other sizable shareholders can try to take advantage of the situation.

“Some of them could even use a general meeting to demand liquidation of Orco’s assets, by which

they could gain better value than the current share price. However, in the current conditions on the

real estate market, we believe a liquidation of the company would be value destroying, as it would

require asset disposal at prices significantly under their book values,” Vyroubal said. He added

that it is in the interest of the shareholders that Orco weathers the current difficult conditions

without further complications. He also said that in any case, it will be beneficial for shareholders

that no changes are introduced to management team. “Efforts to replace the current management

could be expected, however it would not be responsible given the current low share price,”

Vyroubal stated.

Potměšil agrees that one of the possible consequences is a potential change in the Orco

management board. “Under current circumstances this kind of move would be unreasonable because the

company is currently in urgent need of stability. The company needs management continuity to go

through the crisis, so we don’t expect any changes just because Jean-François Ott lost majority

of his shares,” Potměšil added.

Severine Farjon , head of investor relations at Orco Property Group, told CBW that Ott will still

serve as company CEO. ”To my knowledge, there is no change in the board of directors,” she

said.

Orco’s shareholder structure is highly fragmented, and according to analysts the company is

vulnerable to a takeover given current price levels. “The existing shareholders’ constellation

could be an opportunity for such a step, but it is still only a speculation,” Potměšil said.

Josef Němý, equity analyst with Komerční banka (KB), expects that potential suitors

would instead be interested in selected projects than in the entire company. The continuous downward

trend in the share price, however, proves that there is no big interest in Orco shares yet. To avoid

such an attempt, the bylaws of Orco ensure that a new investor couldn’t surprise the company with

a significant stake increase. Orco requires public disclosure of shares ownership after crossing the

2.5 percent stake at the company.

Ott’s stake in early 2007 was worth over €150 million, but is now worth close to €1 million.

Ott is also owner of renewable energy project Green Bear and asset management company Novy Capital

Partners, which since August managed to raise its fund size by approximately €20 million to more

than €50 million despite difficult market conditions. Ott’s stake in Orco can increase in the

future as Ott & Co has around 650,000 warrants, which are convertible into Orco shares. “At the

moment the warrants are out of the money, and conversion wouldn’t be justified,” Veroubal said.

The each warrant entitles the owner to purchase 1.6 shares of the company between years 2012 and

’14, so Ott & Co can purchase up 1 million Orco shares via the warrants.

Source:

http://www.cbw.cz/en/highly-leveraged-ott-quietly-cut-his-orco-stake/9425.html

mmmmmm.....plus c'est long plus c'est bon!!!!!

Yoda , y'a pu d'jeunesse , tu t'encanaille ?

Hè , bé , ! ! ! !

Remarque , je devrais être habitué avec ma fille qui parles comme je le faisait a son age , sauf

que moi , j'étais un jeune homme , et que elle , depuis peu elle est mère au foyer.

si on peux plus rigoler alors!! mince!

Yoda, elle est super bien mais faut pas jouer avec des malades! Et, çui là est très atteint.

Fais gaffe à toi !