chiffres clés

Goodyear & cours du caoutchouc.

14/01/2011 par

Ancien16767

0

Il semblerait que pour la premiere fois depuis decembre, le marche US ait pris note de la tres forte

hausse des cours du coutchouc intervenue sur les deux derniers mois.

Michelin, bien que generalement recommendee a l'achat (tout du moins a moyen-terme), ne cesse de

consolider suite a son augmentation de capital. A l'inverse, les competiteurs US type Goodyear

(effet GM) ou Titan International (effet John Deere / Caterpillar) ont fortement progresse sur la

periode.

Toutefois Goodyear perd 5% en seance aujourd'hui. Est-ce un retournement?

***

Voici l'article sur les cours du caoutchouc, avec le module de google translate pour ceux qui

souhaite une VF.

http://translate.google.com/?hl=en&tab=wT#

Rubber May Extend Rally on Supply Squeeze, Demand, Analysts Say

By Aya Takada and Supunnabul Suwannakij - Jan 13, 2011 5:00 PM GMT

Natural rubber, which has beaten other commodities this year, may extend a record rally as rains cut

supply, compounding a seasonal output drop, while climbing car sales boost demand, according to

analysts and fund managers.

The commodity will “rally until the price reaches a point that will substantially weaken physical

demand,” said Tetsu Emori, a commodity fund manager at Astmax Co. in Tokyo, who correctly forecast

in September a rally to a record. “It’s hard to predict where that level is; it may be 600

yen,” Emori said.

Futures surged to an all-time high yesterday, touching 454.4 yen per kilogram ($5,480 per metric

ton) on the Tokyo Commodity Exchange, extending last year’s 50 percent jump. The advance raises

costs for tiremakers such as Bridgestone Corp. and boosts inflation as other commodities including

grains, metals and crude oil climb. The price may advance to 500 yen in the first half of the year,

according to the median forecast of four analysts and fund managers surveyed by Bloomberg News.

The “rally won’t stop until shipments from Thailand increase,” said Hisaaki Tasaka, an analyst

at Tokyo-based broker ACE Koeki Co., who also predicted in September that the price would rally.

“Rubber futures may climb to 500 yen per kilo by June as supply falls short of rising demand.”

Rubber gained as much as 9.6 percent in Tokyo this year, beating the returns of members in the S&P

GSCI Commodity Index through to the close of trade on Jan. 12. The cash price in Thailand, the

largest supplier, has also gained to a record, reaching 164.8 baht ($5.41) per kilogram yesterday.

Global Deficit

Natural rubber will be in deficit in 2011 for a second year, according to a November estimate from

Niels Fehre, an analyst at HSBC Trinkaus & Burkhardt AG, who wasn’t part of the survey. Global

demand of 10.7 million tons may outpace supply by 513,000 tons this year after a shortage of 417,000

tons in 2010, according to an HSBC report.

“Although prices keep rising, demand remains strong as buyers are accelerating purchases ahead of

the low-production period and Lunar New Year holidays,” Sureerat Kunthongjun, an analyst at AGROW

Enterprise Ltd., said by phone from Bangkok. The week-long holiday in China runs from Feb. 2.

Heavy rain from a La Nina weather event, which has also brought floods to Australia, has hurt

rubber-tapping across Southeast Asia. During the so-called wintering season, which starts next month

and runs until May, Thai rubber output usually shrinks as much as 60 percent from peak levels, the

Association of Natural Rubber Producing Countries said in December.

“Rising car sales have improved optimism that demand for car tires will remain robust, outpacing

inadequate supplies,” said Wanwilai Choilek, manager at the Hadyai, Thailand branch of commodity

broker DS Futures Ltd.

China’s passenger-vehicle sales surged 33 percent in 2010, according to the China Association of

Automobile Manufacturers. Total vehicle sales rose 32 percent to 18.06 million.

Bridgestone Europe, a unit of the biggest tiremaker, raised prices by an average of 6 percent,

citing higher costs, according to a statement on Jan. 10. “We have not seen an end to the

escalation of raw-materials prices,” said Makio Ohashi, chief executive officer and president of

Bridgestone Europe.

***

J'ai retrouve la note de Citigroup sur Goodyear du 7 Janvier qui a fait flamber GT:

En appliquant le meme ratio de 5x core EBITDA(e) 2012 a Michelin, on se rapproche d'un objectif de

cours a €65-€70 pour Michelin. Il y a toutefois des hypoteses forte sur GT sur ce scenario

bullish que je ne partage pas enteirement.

D'autres part, ML a conserve son objectif a $12.50 pour GT, coherant avec la valorisarion actuelle

de Michelin a €52.

J'ai personnellement rachete ma position short a €53.7 le 12 Janv.

La note de Citigroup

Goodyear Tire & Rubber: Upgrade to Buy, This One Could Have 90% Upside – Citi

Goodyear Tire & Rubber: Upgrade to Buy, This One Could Have 90% Upside CitiCitigroup is out with a

bullish U.S. Autos & Auto Parts (47 pg.) call. In the call they are upgrading Goodyear Tire & Rubber

(NYSE:GT) to Buy from Hold with a $17 (up from $14) target noting the name could have 90% upside to

low $20′s.

Proprietary Vehicle Density Survey — Citi’s latest density survey (which forecasts future plans

amongst 2,100 respondents) showed solid improvement from their August survey, revealing a 1.9%

forecasted 2-year density erosion— consistent with a 13-15 million SAAR outlook. More so, firm’s

survey yielded strong indications of existing pent-up demand suggesting that a stronger macro

outcome could conceivably push SAAR to a 14-16mln range.

- Goodyear Tire & Rubber Co (GT): Upgrade to Buy: Out of Favor, But Momentum Could Build in 2011

Citigroup is upgrading Goodyear Tire shares to Buy from Hold, raising the target to $17 from $14 (5x

‘12E EBITDA) and raising the risk rating to Speculative from High in recognition of the unique

volatility in Goodyear’s business model and this stock call. Following significant

underperformance in the shares over the past 12-months, they believe the risk/reward may be poised

to tilt favorably in 2011, as the stock appears washed out and out of favor.

Framing Risk/Reward – Though the Goodyear story has suffered one set back after another

(unabsorbed overhead, rubber, Venezuela), the long-term earnings power of the company hasn’t

changed much. In a year that should see a continued recovery in global volume, improving mix

(aftermarket and commercial) and further cost savings, Goodyear’s future earnings power may

receive a second look from the market. To be sure, Citi still thinks 2011 street estimates need to

come down (rubber re-pricing), but the resetting of expectations should be priced-into the stock and

may actually prove refreshing to the market. At a normalized $2 billion of EBITDA and 5.0x multiple,

upside to a low-$20s (90%) can be justified, a proposition that’s hard to find in autos after a

stellar 2010. Downside risks at a $1.5 billion EBITDA level look to be in around $10 (17%).

Liquidity remains in good shape with ample runway through 2013, in their view.

Recent Management Meetings More Positive – After recently visiting management, Citi notes they

walked away with added comfort on a number of issues :

1) Management continues to believe that the spike in rubber prices is not indicative of a structural

supply/demand issue;

2) Management remains confident that pricing should continue to catch up with raw material

inflation, and the dealer body experienced a strong 2010;

3) Future tire labeling regulations could become a catalyst towards improving Goodyear’s value

proposition;

4) At a normalized $2 billion EBITDA, Goodyear could generate $0.6 billion of free cash flow before

growth capital expenditures (the returns of which would be additive to EBITDA) and pension funding

in excess of expense ($0.2 billion).

A 10x multiple of $0.4 billion FCF (incl. pension) would support Citi’s $17 target. They believe

that confusion over Goodyear’s somewhat complex reporting has contributed to the poor share price,

but also believe that corrective action on the part of management could go a long way to helping

investors frame the earnings power story.

Notablecalls: For several reasons, GT looks like a winner.

- The upgrade is going to catch a lot of people by surprise as the sentiment in the sector has been

on the pessimistic side.

- This thing hasn’t seen a decent upward rating change in a while. Merrill upgraded the name with

a puny 12.50 price target back on Dec 9 2010, causing a 11-12% move on the day. For objectivity’s

sake, a Japanese competitor did announce raising tire prices that same morning.

- Needless to say, GT has lagged the Auto Parts space and now Citi is flashing a +ve low $20′s

scenario (90% upside) in front of investors starving for opportunities like this. That’s how they

generate attention.

I’m thinking this one could trade closer to $13 level today. Use the pull-backs for entry.

hausse des cours du coutchouc intervenue sur les deux derniers mois.

Michelin, bien que generalement recommendee a l'achat (tout du moins a moyen-terme), ne cesse de

consolider suite a son augmentation de capital. A l'inverse, les competiteurs US type Goodyear

(effet GM) ou Titan International (effet John Deere / Caterpillar) ont fortement progresse sur la

periode.

Toutefois Goodyear perd 5% en seance aujourd'hui. Est-ce un retournement?

***

Voici l'article sur les cours du caoutchouc, avec le module de google translate pour ceux qui

souhaite une VF.

http://translate.google.com/?hl=en&tab=wT#

Rubber May Extend Rally on Supply Squeeze, Demand, Analysts Say

By Aya Takada and Supunnabul Suwannakij - Jan 13, 2011 5:00 PM GMT

Natural rubber, which has beaten other commodities this year, may extend a record rally as rains cut

supply, compounding a seasonal output drop, while climbing car sales boost demand, according to

analysts and fund managers.

The commodity will “rally until the price reaches a point that will substantially weaken physical

demand,” said Tetsu Emori, a commodity fund manager at Astmax Co. in Tokyo, who correctly forecast

in September a rally to a record. “It’s hard to predict where that level is; it may be 600

yen,” Emori said.

Futures surged to an all-time high yesterday, touching 454.4 yen per kilogram ($5,480 per metric

ton) on the Tokyo Commodity Exchange, extending last year’s 50 percent jump. The advance raises

costs for tiremakers such as Bridgestone Corp. and boosts inflation as other commodities including

grains, metals and crude oil climb. The price may advance to 500 yen in the first half of the year,

according to the median forecast of four analysts and fund managers surveyed by Bloomberg News.

The “rally won’t stop until shipments from Thailand increase,” said Hisaaki Tasaka, an analyst

at Tokyo-based broker ACE Koeki Co., who also predicted in September that the price would rally.

“Rubber futures may climb to 500 yen per kilo by June as supply falls short of rising demand.”

Rubber gained as much as 9.6 percent in Tokyo this year, beating the returns of members in the S&P

GSCI Commodity Index through to the close of trade on Jan. 12. The cash price in Thailand, the

largest supplier, has also gained to a record, reaching 164.8 baht ($5.41) per kilogram yesterday.

Global Deficit

Natural rubber will be in deficit in 2011 for a second year, according to a November estimate from

Niels Fehre, an analyst at HSBC Trinkaus & Burkhardt AG, who wasn’t part of the survey. Global

demand of 10.7 million tons may outpace supply by 513,000 tons this year after a shortage of 417,000

tons in 2010, according to an HSBC report.

“Although prices keep rising, demand remains strong as buyers are accelerating purchases ahead of

the low-production period and Lunar New Year holidays,” Sureerat Kunthongjun, an analyst at AGROW

Enterprise Ltd., said by phone from Bangkok. The week-long holiday in China runs from Feb. 2.

Heavy rain from a La Nina weather event, which has also brought floods to Australia, has hurt

rubber-tapping across Southeast Asia. During the so-called wintering season, which starts next month

and runs until May, Thai rubber output usually shrinks as much as 60 percent from peak levels, the

Association of Natural Rubber Producing Countries said in December.

“Rising car sales have improved optimism that demand for car tires will remain robust, outpacing

inadequate supplies,” said Wanwilai Choilek, manager at the Hadyai, Thailand branch of commodity

broker DS Futures Ltd.

China’s passenger-vehicle sales surged 33 percent in 2010, according to the China Association of

Automobile Manufacturers. Total vehicle sales rose 32 percent to 18.06 million.

Bridgestone Europe, a unit of the biggest tiremaker, raised prices by an average of 6 percent,

citing higher costs, according to a statement on Jan. 10. “We have not seen an end to the

escalation of raw-materials prices,” said Makio Ohashi, chief executive officer and president of

Bridgestone Europe.

***

J'ai retrouve la note de Citigroup sur Goodyear du 7 Janvier qui a fait flamber GT:

En appliquant le meme ratio de 5x core EBITDA(e) 2012 a Michelin, on se rapproche d'un objectif de

cours a €65-€70 pour Michelin. Il y a toutefois des hypoteses forte sur GT sur ce scenario

bullish que je ne partage pas enteirement.

D'autres part, ML a conserve son objectif a $12.50 pour GT, coherant avec la valorisarion actuelle

de Michelin a €52.

J'ai personnellement rachete ma position short a €53.7 le 12 Janv.

La note de Citigroup

Goodyear Tire & Rubber: Upgrade to Buy, This One Could Have 90% Upside – Citi

Goodyear Tire & Rubber: Upgrade to Buy, This One Could Have 90% Upside CitiCitigroup is out with a

bullish U.S. Autos & Auto Parts (47 pg.) call. In the call they are upgrading Goodyear Tire & Rubber

(NYSE:GT) to Buy from Hold with a $17 (up from $14) target noting the name could have 90% upside to

low $20′s.

Proprietary Vehicle Density Survey — Citi’s latest density survey (which forecasts future plans

amongst 2,100 respondents) showed solid improvement from their August survey, revealing a 1.9%

forecasted 2-year density erosion— consistent with a 13-15 million SAAR outlook. More so, firm’s

survey yielded strong indications of existing pent-up demand suggesting that a stronger macro

outcome could conceivably push SAAR to a 14-16mln range.

- Goodyear Tire & Rubber Co (GT): Upgrade to Buy: Out of Favor, But Momentum Could Build in 2011

Citigroup is upgrading Goodyear Tire shares to Buy from Hold, raising the target to $17 from $14 (5x

‘12E EBITDA) and raising the risk rating to Speculative from High in recognition of the unique

volatility in Goodyear’s business model and this stock call. Following significant

underperformance in the shares over the past 12-months, they believe the risk/reward may be poised

to tilt favorably in 2011, as the stock appears washed out and out of favor.

Framing Risk/Reward – Though the Goodyear story has suffered one set back after another

(unabsorbed overhead, rubber, Venezuela), the long-term earnings power of the company hasn’t

changed much. In a year that should see a continued recovery in global volume, improving mix

(aftermarket and commercial) and further cost savings, Goodyear’s future earnings power may

receive a second look from the market. To be sure, Citi still thinks 2011 street estimates need to

come down (rubber re-pricing), but the resetting of expectations should be priced-into the stock and

may actually prove refreshing to the market. At a normalized $2 billion of EBITDA and 5.0x multiple,

upside to a low-$20s (90%) can be justified, a proposition that’s hard to find in autos after a

stellar 2010. Downside risks at a $1.5 billion EBITDA level look to be in around $10 (17%).

Liquidity remains in good shape with ample runway through 2013, in their view.

Recent Management Meetings More Positive – After recently visiting management, Citi notes they

walked away with added comfort on a number of issues :

1) Management continues to believe that the spike in rubber prices is not indicative of a structural

supply/demand issue;

2) Management remains confident that pricing should continue to catch up with raw material

inflation, and the dealer body experienced a strong 2010;

3) Future tire labeling regulations could become a catalyst towards improving Goodyear’s value

proposition;

4) At a normalized $2 billion EBITDA, Goodyear could generate $0.6 billion of free cash flow before

growth capital expenditures (the returns of which would be additive to EBITDA) and pension funding

in excess of expense ($0.2 billion).

A 10x multiple of $0.4 billion FCF (incl. pension) would support Citi’s $17 target. They believe

that confusion over Goodyear’s somewhat complex reporting has contributed to the poor share price,

but also believe that corrective action on the part of management could go a long way to helping

investors frame the earnings power story.

Notablecalls: For several reasons, GT looks like a winner.

- The upgrade is going to catch a lot of people by surprise as the sentiment in the sector has been

on the pessimistic side.

- This thing hasn’t seen a decent upward rating change in a while. Merrill upgraded the name with

a puny 12.50 price target back on Dec 9 2010, causing a 11-12% move on the day. For objectivity’s

sake, a Japanese competitor did announce raising tire prices that same morning.

- Needless to say, GT has lagged the Auto Parts space and now Citi is flashing a +ve low $20′s

scenario (90% upside) in front of investors starving for opportunities like this. That’s how they

generate attention.

I’m thinking this one could trade closer to $13 level today. Use the pull-backs for entry.

Oui, Oui, enfin Si ou Yes,

Bonne approche, mais j'en ai une autre, beaucoup plus basique, que j'ai déjà expliquée sur ce

forum.

ML baisse pourquoi ? parce que la matière 1ère (tient encore elle) l'évéa, monte.

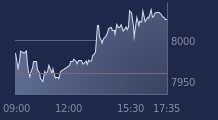

Simple : le graph montre une déscente vers un plancher de 50.4 et il semble que beaucoup règle

leur ordi sur les graph. donc on joue la baisse;

La mat. 1ère, voir le fournisseur d'évéa : exemple SIPH depuis le 20/3/2009 à 14€08 est

resté dans un canal ascendant, ce jour 109€40 (+3.99 encore) il fallait jouer la hausse depuis

longtemps.

Je ne suis pas sûr que cette vision soit décrite chaque jour sur les sites.

Bonne approche, mais j'en ai une autre, beaucoup plus basique, que j'ai déjà expliquée sur ce

forum.

ML baisse pourquoi ? parce que la matière 1ère (tient encore elle) l'évéa, monte.

Simple : le graph montre une déscente vers un plancher de 50.4 et il semble que beaucoup règle

leur ordi sur les graph. donc on joue la baisse;

La mat. 1ère, voir le fournisseur d'évéa : exemple SIPH depuis le 20/3/2009 à 14€08 est

resté dans un canal ascendant, ce jour 109€40 (+3.99 encore) il fallait jouer la hausse depuis

longtemps.

Je ne suis pas sûr que cette vision soit décrite chaque jour sur les sites.

14/01/2011 par

Ancien16767

0

Antares,

Tu as absolument raison, c'est pourquoi j'avais Michelin en position short a partir des €58

apres l'augmentation de capital, tant pour des raisons fondamentales de valorisation (le cours

n'est pas moins cher maintenant qu'il ne l'etait en 2007 a PBT N+1 equivalent), que de marges a

court terme.

J'ai pose plusieurs messages sur ce sujet sur un autre forum, entre autres sur coutchouc naturel vs

synthetique (Lanxess AG), premiere monte vs seconde monte, truck vs cars,...

J'ai quelque part l'impact des variations du cours du caoutchouc et derives petroliers sur les

marges - perdu dans la masse des papiers sur mon bureau.

Il me semble que les analystes reverront quelque peu leur marge operationnelle a la baisse, mais je

n'ai pas plus d'info que quiquonque.

J'ai toutefois rachete ma position short avant hier, et suis passe en position longue aujourd'hui.

Oublions les investissements au Bresil, les possibilite d'achat des Coreens, etc,...

J'ai pris une approche un peu technique. UBS a mis le titre dans sa liste des "least preferred

stocks" ce matin, en remplacement de GKN (un Valeo britannique). On savait UBS negatif sur le cours

du titre, ils l'ont confirme ce jour. Ca a mis le titre sous pression toute la matinee.

Toutefois il a fortement rebondi sur ses €52, ce qui me fait penser que les positions shorts avec

l'appuie d'une note, sont arrivees au bout de la logique. D'ou un achat - technique de ma part.

A noter egalement que Michelin a rebondi malgre une nouvelle baisse de GT.

Enfin sur l'analyse de UBS, on peut noter que GKN a tres fortement progresse recemment. Il me

semble que l'analyste est a contre-courant.

Le trading / approche technique n'est pas mon fort, donc j'espere ne pas me planter.

Le site des Echos permet de suivre aisemment les cours du caoutchouc, correles aux cours du petrole

via les produits petroliers derives. Les pluies torrentielles en Asie du Sud-Est n'aident pas non

plus.

Bon week-end

Tu as absolument raison, c'est pourquoi j'avais Michelin en position short a partir des €58

apres l'augmentation de capital, tant pour des raisons fondamentales de valorisation (le cours

n'est pas moins cher maintenant qu'il ne l'etait en 2007 a PBT N+1 equivalent), que de marges a

court terme.

J'ai pose plusieurs messages sur ce sujet sur un autre forum, entre autres sur coutchouc naturel vs

synthetique (Lanxess AG), premiere monte vs seconde monte, truck vs cars,...

J'ai quelque part l'impact des variations du cours du caoutchouc et derives petroliers sur les

marges - perdu dans la masse des papiers sur mon bureau.

Il me semble que les analystes reverront quelque peu leur marge operationnelle a la baisse, mais je

n'ai pas plus d'info que quiquonque.

J'ai toutefois rachete ma position short avant hier, et suis passe en position longue aujourd'hui.

Oublions les investissements au Bresil, les possibilite d'achat des Coreens, etc,...

J'ai pris une approche un peu technique. UBS a mis le titre dans sa liste des "least preferred

stocks" ce matin, en remplacement de GKN (un Valeo britannique). On savait UBS negatif sur le cours

du titre, ils l'ont confirme ce jour. Ca a mis le titre sous pression toute la matinee.

Toutefois il a fortement rebondi sur ses €52, ce qui me fait penser que les positions shorts avec

l'appuie d'une note, sont arrivees au bout de la logique. D'ou un achat - technique de ma part.

A noter egalement que Michelin a rebondi malgre une nouvelle baisse de GT.

Enfin sur l'analyse de UBS, on peut noter que GKN a tres fortement progresse recemment. Il me

semble que l'analyste est a contre-courant.

Le trading / approche technique n'est pas mon fort, donc j'espere ne pas me planter.

Le site des Echos permet de suivre aisemment les cours du caoutchouc, correles aux cours du petrole

via les produits petroliers derives. Les pluies torrentielles en Asie du Sud-Est n'aident pas non

plus.

Bon week-end

25/01/2011 par

Ancien16767

0

Pour la premiere fois depuis des lunes les cours du caoutchouc refluent. Les cours du petrole WTI

(le Brent, acutellement en situation de corner sur les deux prochaines echeances est peu

representatif) et derives ont probablement un impact indirect - difficiles a quantifier. La hausse

reste tout de meme a +15% depuis le debut de l'annee et la marge operationnelle de ML s'en

ressentira.

Delticom AG - un detaillant europeen de pneus a eu un bon Q4 grace a l'effet neige - un one-off par

definition.

Je reste sur le dossier en approche contrariante.

Bons trades

(le Brent, acutellement en situation de corner sur les deux prochaines echeances est peu

representatif) et derives ont probablement un impact indirect - difficiles a quantifier. La hausse

reste tout de meme a +15% depuis le debut de l'annee et la marge operationnelle de ML s'en

ressentira.

Delticom AG - un detaillant europeen de pneus a eu un bon Q4 grace a l'effet neige - un one-off par

definition.

Je reste sur le dossier en approche contrariante.

Bons trades

"...reflux ? le cours du caoutchouc" pa sûr, regarde SIPH de 109.50 résistance renvoyé

effectivement à 90, mais remonte graphiquement et ce matin + 3.16. D'autes conseillent même

l'achat. Alors ! ...

effectivement à 90, mais remonte graphiquement et ce matin + 3.16. D'autes conseillent même

l'achat. Alors ! ...

27/01/2011 par

Ancien16767

0

Antares,

Je ne mentionnais pas SIPH, simplement les cours du caoutchouc tels que cotes sur les marche a terme

d'Osaka. Je ne suis pas SIPH, ma plateforme de spreadbet trading n'offrant pas le titre. Ceci dit,

l'automobile etant la principale application du tchouc, il n'est pas etonnant que SIPH ait pu

consolider quelque peu comme l'on fait les valeurs auto la semaine passee.

Aujourd'hui VW a dit etre en manque de composants du a l'explostion de la demande pour ses

modeles. Hier, STM a indique une forte demande de la part du secteur auto.

Sinon une journee de chien pour moi avec Heritage Oil en chute de 30% (solde a -15%) pour avoir

trouve un enorme champs gazier au Kurdistan - le marche attendait du petrole. Le gaz, sans les

infrastructures, ca ne vaut pas grand chose.

J'ai un short sur Nokia qui publie demain. Les ventes trimestrielles decevantes de RFMD hier - dont

le premier client est Nokia - vont dans le bon sens, mais on ne sait jamais avec les attentes de

marche -: la moitie des analystes sont deja neutres et le cours n'a pas fait grand chose. Le titre

est faiblement shorte d'apres Dataexplorer, donc un moindre de risque de rachats intempestifs.

A +

Je ne mentionnais pas SIPH, simplement les cours du caoutchouc tels que cotes sur les marche a terme

d'Osaka. Je ne suis pas SIPH, ma plateforme de spreadbet trading n'offrant pas le titre. Ceci dit,

l'automobile etant la principale application du tchouc, il n'est pas etonnant que SIPH ait pu

consolider quelque peu comme l'on fait les valeurs auto la semaine passee.

Aujourd'hui VW a dit etre en manque de composants du a l'explostion de la demande pour ses

modeles. Hier, STM a indique une forte demande de la part du secteur auto.

Sinon une journee de chien pour moi avec Heritage Oil en chute de 30% (solde a -15%) pour avoir

trouve un enorme champs gazier au Kurdistan - le marche attendait du petrole. Le gaz, sans les

infrastructures, ca ne vaut pas grand chose.

J'ai un short sur Nokia qui publie demain. Les ventes trimestrielles decevantes de RFMD hier - dont

le premier client est Nokia - vont dans le bon sens, mais on ne sait jamais avec les attentes de

marche -: la moitie des analystes sont deja neutres et le cours n'a pas fait grand chose. Le titre

est faiblement shorte d'apres Dataexplorer, donc un moindre de risque de rachats intempestifs.

A +

11/02/2011 par

Ancien16767

0

C'est mon jour! Michelin en hausse de 10 % depuis mon achat et Nokia en chute equivalente depuis

l'ouverture d'une position short. Il est temps de booker les gains.

l'ouverture d'une position short. Il est temps de booker les gains.

11/02/2011 par

Ancien27690

0

J'ai fais ma petite PV de 44% ( call ). Je coupe aussi. Sage décision

10/03/2011 par

Ancien16767

0

Bon, j'avais solde les Michelin il y a quinze jours, et me voila a me repositionner sur le titre.

J'ai note que les analystes ont revu a la hausse leur prevision sur 2011 sur la semaine ecoule, un

analyste a cesse d'etre vendeur, et le price target moyen a grimpe. Pirelli a sorti de bons

resultats cette semaine. Enfin les cours du caoutchouc on baisse de plus de 15% depuis le pic de

mi-fevrier.

J'ai profite de la baisse de 2% de ce jour avec un achat sur le bid a €59.55 - CAC 40 a 3960

Edit:

Que le temps passe vite ! Cela fait il y a deja un mois que j'avais solde les Mimil.

J'ai note que les analystes ont revu a la hausse leur prevision sur 2011 sur la semaine ecoule, un

analyste a cesse d'etre vendeur, et le price target moyen a grimpe. Pirelli a sorti de bons

resultats cette semaine. Enfin les cours du caoutchouc on baisse de plus de 15% depuis le pic de

mi-fevrier.

J'ai profite de la baisse de 2% de ce jour avec un achat sur le bid a €59.55 - CAC 40 a 3960

Edit:

Que le temps passe vite ! Cela fait il y a deja un mois que j'avais solde les Mimil.

10/03/2011 par

Ancien16767

0

Petit recapitulatif des hausses de prix par les differents manufacturiers de pneus aux Etats-Unis.

La liste des augmentations est longue, et demontre la bonne discipline des fabricants. Pricing power

is back (lol).

L'article date du 8 mars.

Continental Tire the Americas LLC will increase the price of its Continental, General and AmeriSteel

brand truck tires by 10% effective April 1 for replacement sales channels in the U.S. only.

The reason for the price hike is the continued escalation of raw material and energy costs, the

company says.

Continental is the latest tire manufacturer to announce price increases this year. Here's a

rundown:

Consumer

* Michelin North America Inc. will be increasing prices up to 8.5% on Michelin, BFGoodrich, Uniroyal

and private and associate passenger and light truck replacement tires sold in the U.S. The prices

will go into effect May 1. Michelin also raised prices on Feb. 1 (the increases varied by product

line).

* Nexen Tire America Inc. will raise tire prices up to 8% effective April 1, 2011. The increases

will be applied to warehouse orders and April FDC production. Nexen also raised prices "up to 8%"

on Jan. 1.

* Toyo Tire U.S.A. Corp. increased prices on passenger and light truck tires by an average of 8%,

with in-line adjustments, effective March 1.

* Hankook Tire America Corp. will increase prices on its full line of passenger and light truck

tires by a weighted average of 7%. The increases will go into effect April 1.

* Cooper will raise prices on its light vehicle tires effective March 15. The increases in total

will average around 8% to 9%, with in-line adjustments.

* Continental Tire the Americas LLC will raise consumer tire prices in the U.S. up to 6%, with some

in-line adjustments, effective April 1.

* Federal Corp. raised prices on its passenger and light truck tires by up to 12% effective March 1.

The percentage increase varied by product lines and continents. There also were in-line adjustments

for all onward orders and remaining back orders.

* Yokohama increased prices by up to 8% on all of its consumer tires effective March 1, 2011.

* Kumho Tire U.S.A. Inc. raised prices on all passenger, light truck and medium truck tires

effective March 1. Kumho says the details of this increase will be provided to its customers in the

near future.

* Goodyear Tire & Rubber Co. raised consumer tire prices on March 1. The increase, up to 6%, applied

to all brands in the U.S. and Canada.

* Falken Tire Corp. also raised prices on March 1. The price hikes on Falken passenger and light

truck tires ranged from 5% to 8% depending on the size, with in-line adjustments as needed.

* Bridgestone Americas Tire Operations LLC will raise replacement and original equipment consumer

tire prices one month later, on April 1, The increases on Bridgestone, Firestone and associate brand

passenger and light truck tires in the U.S. and Canada will vary up to 8%.

Commercial

* Yokohama Tire Corp. will implement a price increase on all of its light and medium commercial

truck tires in the United States effective April 1, 2011. Prices will be raised an average of 8%,

with in-line adjustments.

* Double Coin and China Manufacturers Alliance LLC (CMA) hiked commercial tire prices an average of

13% on March 1. The price increases applied to the Double Coin radial truck and bus tires, all of

its private brand radial truck and bus tires, and Double Coin radial off-the-road tires.

* Toyo increased prices on its commercial truck and OTR tires by an average of 8%, with in-line

adjustments, on March 1.

* Michelin increased prices on its commercial products in the U.S. effective March 1. The company

also raised prices an average of 12% on Michelin and BFGoodrich truck tires and Michelin Retread

Technologies and Oliver retread products.

* Hankook will increase prices on its medium truck tires by a weighted average of 9%. The increases

will go into effect on tire shipments made on or after March 15, 2011.

* Titan Tire Corp. will raise prices on its farm and construction tires effective April 1, 2011. The

increases, up to 8%, will apply to both Titan branded products and Goodyear branded tires

manufactured by Titan. Certain tire prices "may rise in excess of 8% due to realignment and

positioning of the product," said the company.

* Cooper Tire raised its commercial truck tire prices 12% across the board during the week of Feb.

6, 2010.

* The Bridgestone Off Road Tire, U.S. & Canada Commercial Tire Sales division increased prices on

its mining, construction and industrial tires by 12%, "with some in-line adjustments" on March 1.

* The Bridgestone Agricultural Tire, U.S. & Canada Commercial Tire Sales division announced a 4%

price increase effective April 1 on the following tires: Firestone agricultural, construction and

forestry tires; Bridgestone garden tires; and Regency tires sold in the United States and Canadian

replacement markets.

* Michelin increased prices on Michelin brand replacement agricultural tires sold in the U.S. and

Canada on March 1. The hikes were up to 8%.

The company already increased prices on its Michelin earthmover and industrial replacement tires

sold in North America up to 7% on Feb. 1. It increased prices on Oliver and MegaMile retread rubber

products sold in the U.S. up to 7% on Jan. 3.

CGS Tyres Group (7.5% to 10% on farm and industrial tires), Titan Tire Corp. (up to 8% on farm and

OTR tires), Yokohama Tire Corp. (up to 5% on bias and radial OTR tires) and Continental Tire the

Americas LLC (up to 8% on truck tires) raised their commercial tire prices on Jan. 1.

La liste des augmentations est longue, et demontre la bonne discipline des fabricants. Pricing power

is back (lol).

L'article date du 8 mars.

Continental Tire the Americas LLC will increase the price of its Continental, General and AmeriSteel

brand truck tires by 10% effective April 1 for replacement sales channels in the U.S. only.

The reason for the price hike is the continued escalation of raw material and energy costs, the

company says.

Continental is the latest tire manufacturer to announce price increases this year. Here's a

rundown:

Consumer

* Michelin North America Inc. will be increasing prices up to 8.5% on Michelin, BFGoodrich, Uniroyal

and private and associate passenger and light truck replacement tires sold in the U.S. The prices

will go into effect May 1. Michelin also raised prices on Feb. 1 (the increases varied by product

line).

* Nexen Tire America Inc. will raise tire prices up to 8% effective April 1, 2011. The increases

will be applied to warehouse orders and April FDC production. Nexen also raised prices "up to 8%"

on Jan. 1.

* Toyo Tire U.S.A. Corp. increased prices on passenger and light truck tires by an average of 8%,

with in-line adjustments, effective March 1.

* Hankook Tire America Corp. will increase prices on its full line of passenger and light truck

tires by a weighted average of 7%. The increases will go into effect April 1.

* Cooper will raise prices on its light vehicle tires effective March 15. The increases in total

will average around 8% to 9%, with in-line adjustments.

* Continental Tire the Americas LLC will raise consumer tire prices in the U.S. up to 6%, with some

in-line adjustments, effective April 1.

* Federal Corp. raised prices on its passenger and light truck tires by up to 12% effective March 1.

The percentage increase varied by product lines and continents. There also were in-line adjustments

for all onward orders and remaining back orders.

* Yokohama increased prices by up to 8% on all of its consumer tires effective March 1, 2011.

* Kumho Tire U.S.A. Inc. raised prices on all passenger, light truck and medium truck tires

effective March 1. Kumho says the details of this increase will be provided to its customers in the

near future.

* Goodyear Tire & Rubber Co. raised consumer tire prices on March 1. The increase, up to 6%, applied

to all brands in the U.S. and Canada.

* Falken Tire Corp. also raised prices on March 1. The price hikes on Falken passenger and light

truck tires ranged from 5% to 8% depending on the size, with in-line adjustments as needed.

* Bridgestone Americas Tire Operations LLC will raise replacement and original equipment consumer

tire prices one month later, on April 1, The increases on Bridgestone, Firestone and associate brand

passenger and light truck tires in the U.S. and Canada will vary up to 8%.

Commercial

* Yokohama Tire Corp. will implement a price increase on all of its light and medium commercial

truck tires in the United States effective April 1, 2011. Prices will be raised an average of 8%,

with in-line adjustments.

* Double Coin and China Manufacturers Alliance LLC (CMA) hiked commercial tire prices an average of

13% on March 1. The price increases applied to the Double Coin radial truck and bus tires, all of

its private brand radial truck and bus tires, and Double Coin radial off-the-road tires.

* Toyo increased prices on its commercial truck and OTR tires by an average of 8%, with in-line

adjustments, on March 1.

* Michelin increased prices on its commercial products in the U.S. effective March 1. The company

also raised prices an average of 12% on Michelin and BFGoodrich truck tires and Michelin Retread

Technologies and Oliver retread products.

* Hankook will increase prices on its medium truck tires by a weighted average of 9%. The increases

will go into effect on tire shipments made on or after March 15, 2011.

* Titan Tire Corp. will raise prices on its farm and construction tires effective April 1, 2011. The

increases, up to 8%, will apply to both Titan branded products and Goodyear branded tires

manufactured by Titan. Certain tire prices "may rise in excess of 8% due to realignment and

positioning of the product," said the company.

* Cooper Tire raised its commercial truck tire prices 12% across the board during the week of Feb.

6, 2010.

* The Bridgestone Off Road Tire, U.S. & Canada Commercial Tire Sales division increased prices on

its mining, construction and industrial tires by 12%, "with some in-line adjustments" on March 1.

* The Bridgestone Agricultural Tire, U.S. & Canada Commercial Tire Sales division announced a 4%

price increase effective April 1 on the following tires: Firestone agricultural, construction and

forestry tires; Bridgestone garden tires; and Regency tires sold in the United States and Canadian

replacement markets.

* Michelin increased prices on Michelin brand replacement agricultural tires sold in the U.S. and

Canada on March 1. The hikes were up to 8%.

The company already increased prices on its Michelin earthmover and industrial replacement tires

sold in North America up to 7% on Feb. 1. It increased prices on Oliver and MegaMile retread rubber

products sold in the U.S. up to 7% on Jan. 3.

CGS Tyres Group (7.5% to 10% on farm and industrial tires), Titan Tire Corp. (up to 8% on farm and

OTR tires), Yokohama Tire Corp. (up to 5% on bias and radial OTR tires) and Continental Tire the

Americas LLC (up to 8% on truck tires) raised their commercial tire prices on Jan. 1.

Bonjour Alpha,

très informé et très argurmenté, ton avis donne envie ... de se positionner .

Il faudra passer la barre des 61.50 , résistance récente par 2 fois, le cac influence aussi le

cours des valeurs, mais tu es dans le vrai.

Caoutchouc descend, Michelin a une participation de 20 % DANS SHIP qui va chercher son seuil je

pense, attendre pour se positionner sur ship.

très informé et très argurmenté, ton avis donne envie ... de se positionner .

Il faudra passer la barre des 61.50 , résistance récente par 2 fois, le cac influence aussi le

cours des valeurs, mais tu es dans le vrai.

Caoutchouc descend, Michelin a une participation de 20 % DANS SHIP qui va chercher son seuil je

pense, attendre pour se positionner sur ship.

14/03/2011 par

Ancien16767

0

Michelin grimpe dans un marche baissier.

Leur exposition sur le Japon est minimale et purement commerciale. Comme leurs concurrents US, ils

profite en Bourse probablement des difficultes logistiques rencontrees par Bridgestone (la base

industrielle japonaise de Bridgestone est epargnee) ainsi que la baisse des cours du caoutchouc qui

font suite a l'arret provisoire de la production automobile japonaise.

Mon autre holding, Valeo, prend un serieux revers, avec l'exposition a Nissan et le rachat de

Niles. Il me semble que 3% de baisse, c'est cher paye, mais c'est le marche.

Leur exposition sur le Japon est minimale et purement commerciale. Comme leurs concurrents US, ils

profite en Bourse probablement des difficultes logistiques rencontrees par Bridgestone (la base

industrielle japonaise de Bridgestone est epargnee) ainsi que la baisse des cours du caoutchouc qui

font suite a l'arret provisoire de la production automobile japonaise.

Mon autre holding, Valeo, prend un serieux revers, avec l'exposition a Nissan et le rachat de

Niles. Il me semble que 3% de baisse, c'est cher paye, mais c'est le marche.

23/03/2011 par

Ancien16767

0

Goodyear GT a eu sa journee investisseurs hier.

Je n'ai pas encore le detail. Le titre a baisse de ~3% en sceance, probablement sur des prises de

profit apres la forte hausse depuis le debut de l'annee.

Deux points a noter:

De nouvelle hausse des prix de ventes ont ete annoncees, ce qui confirme la discipline des

industriels a repercuter la hausse des cours des MP.

Un objectif de $1.6bn d'EBIT en 2013 contre $1.3bn attendus.

Michelin est l'une de mes plus grosses positions, et la seule dans le secteur auto apres avoir

vendu Valeo il y a quelques jours sur les craintes de la chaine logistique. Le titre rebondira.

J'ai ouvert une position short hier sur Johnson Control Instruments - qui peut se resumer a

Valeo/TRW/Faurecia + Saft + Schneider Electric/Honeywell - et se traite a 16x 2011. Valeo et

Schneider semblent tres peu valorisees en comparaison.

Incidemment Johnson a vendu ses operations de sous-traitance chinoises servant Nissan China (siege

automobie) a Faurecia quelques jours avant le tsunami.

***

Goodyear Tire & Rubber Co. (GT - Analyst Report) announced that it would raise prices of its

commercial truck tires by 15% and the price of tread rubber by as much as 7% from the next month.

The price increases were driven by soaring price of raw materials.

Rubber, both natural and synthetic, is primarily used for manufacturing tires. This apart, carbon

black, sulfur and other chemicals are used in tires.

Recently, natural rubber prices reached historic high due to surging demand in Asia, particularly

China – the world’s largest rubber consumer. Moreover, there is a shortage in supply of natural

rubber due to heavy rain in the main rubber producing countries, thereby pushing up its price.

Je n'ai pas encore le detail. Le titre a baisse de ~3% en sceance, probablement sur des prises de

profit apres la forte hausse depuis le debut de l'annee.

Deux points a noter:

De nouvelle hausse des prix de ventes ont ete annoncees, ce qui confirme la discipline des

industriels a repercuter la hausse des cours des MP.

Un objectif de $1.6bn d'EBIT en 2013 contre $1.3bn attendus.

Michelin est l'une de mes plus grosses positions, et la seule dans le secteur auto apres avoir

vendu Valeo il y a quelques jours sur les craintes de la chaine logistique. Le titre rebondira.

J'ai ouvert une position short hier sur Johnson Control Instruments - qui peut se resumer a

Valeo/TRW/Faurecia + Saft + Schneider Electric/Honeywell - et se traite a 16x 2011. Valeo et

Schneider semblent tres peu valorisees en comparaison.

Incidemment Johnson a vendu ses operations de sous-traitance chinoises servant Nissan China (siege

automobie) a Faurecia quelques jours avant le tsunami.

***

Goodyear Tire & Rubber Co. (GT - Analyst Report) announced that it would raise prices of its

commercial truck tires by 15% and the price of tread rubber by as much as 7% from the next month.

The price increases were driven by soaring price of raw materials.

Rubber, both natural and synthetic, is primarily used for manufacturing tires. This apart, carbon

black, sulfur and other chemicals are used in tires.

Recently, natural rubber prices reached historic high due to surging demand in Asia, particularly

China – the world’s largest rubber consumer. Moreover, there is a shortage in supply of natural

rubber due to heavy rain in the main rubber producing countries, thereby pushing up its price.

Bonjour Alpha, Effectivement tu ne risques pas grand chose avec Michelin, mais évolue depuis un

petit moment dans range 56/57-61.50, pour un spécialiste des roues ça n'avance pas vite.

Perso je fais du yo yo avec POM, vendu UG avant baisse avec marge très minime.

Essayé SU mais dans le contexte, vendu petite marge, vendu saft aussi dans de bonnes conditions

largement avant annonce de réduction de marge au vu de leurs investissements en Californie je crois

.

Bonne idée ta valeur JOHNSON CONTROL, à suivre ...

Par contre comparer la valorisation (PER) des valleurs FRANCE/US est une indication, mais un repère

pas sûr !... sur l'évolution du cours en séance à court terme, oui.

petit moment dans range 56/57-61.50, pour un spécialiste des roues ça n'avance pas vite.

Perso je fais du yo yo avec POM, vendu UG avant baisse avec marge très minime.

Essayé SU mais dans le contexte, vendu petite marge, vendu saft aussi dans de bonnes conditions

largement avant annonce de réduction de marge au vu de leurs investissements en Californie je crois

.

Bonne idée ta valeur JOHNSON CONTROL, à suivre ...

Par contre comparer la valorisation (PER) des valleurs FRANCE/US est une indication, mais un repère

pas sûr !... sur l'évolution du cours en séance à court terme, oui.

23/03/2011 par

Ancien16767

0

Salut Antares,

Pris toute cette matinee avec le Budget britannique. Reduction du taux d'imposition des societes de

2pt cette annee (1pt mieux qu'attendu) et de 1pt par an sur les deux annees suivantes! Soit 4pt.

Ce devrait etre positf pour les small caps.

Sur Johnson Controls, entierement d'accord avec toi - les valeurs US se traitent a 20% premium sur

leurs equivalents europeennes depuis la foutue crise des soveign en Mai dernier (on va envoyer la

facture aux Irelandais/Grecs/Portuguais pour rencherissement du cout du capital dans le reste de

l'Europe - non seulement des obligations - mais egalement des actions). Ce sont ces 20% mon

benchmark - 30% premium = 10% overvalued.

Bien vu sur POM. Tres bien vu.

Je ne connais pas bien SAFT, tu as une idee sur le sentiments des brokers?

Pris toute cette matinee avec le Budget britannique. Reduction du taux d'imposition des societes de

2pt cette annee (1pt mieux qu'attendu) et de 1pt par an sur les deux annees suivantes! Soit 4pt.

Ce devrait etre positf pour les small caps.

Sur Johnson Controls, entierement d'accord avec toi - les valeurs US se traitent a 20% premium sur

leurs equivalents europeennes depuis la foutue crise des soveign en Mai dernier (on va envoyer la

facture aux Irelandais/Grecs/Portuguais pour rencherissement du cout du capital dans le reste de

l'Europe - non seulement des obligations - mais egalement des actions). Ce sont ces 20% mon

benchmark - 30% premium = 10% overvalued.

Bien vu sur POM. Tres bien vu.

Je ne connais pas bien SAFT, tu as une idee sur le sentiments des brokers?

25/03/2011 par

Ancien16767

0

Rubber Declines on Concern Demand May Fall Amid China Policy Tightening

By Bloomberg News - Mar 25, 2011 4:09 AM GMT

http://www.bloomberg.com/news/2011-03-25/rubber-declines-on-concern-demand-may-fall-amid-china-polic

y-tightening.html

Rubber in Tokyo declined, paring a weekly gain, on concern demand from China, the biggest consumer,

may stall as the government continues to tighten monetary policy to rein in inflation.

The August-delivery contract on the Tokyo Commodity Exchange fell as much as 3.9 percent to 419.2

yen a kilo ($5,175 a metric ton) and traded at 429 yen by 12:55 p.m. local time. Futures have gained

5 percent this week, rallying to 446.9 yen on March 23, more than 33 percent higher than a

four-month low reached this month, after Thailand, Indonesia and Malaysia, the three biggest

producers, agreed in principle to delay exports if prices tumbled.

“The rally might fizzle out if the biggest buyer China doesn’t step up to the plate and start

buying in big volume,” Forest Hu, manager at the rubber department of PKU Founder Commodities

Group Co., said by phone from Shanghai today. “From here we can see that China’s tightening

looks set to continue so demand might be crimped.”

The central bank has raised interest rates three times since October to cool inflation that reached

4.9 percent in February, exceeding the government’s 4 percent annual target. It has boosted

banks’ reserve requirements nine times since the start of 2010, including an increase of half a

percentage point from today.

China’s consumer prices may rise about 5 percent in March from a year earlier, the China

Securities Journal reported today, citing a report by the pricing department of the National

Development and Reform Commission. Prices in the first quarter may have gained about 4.9 percent,

the report said.

China Supply

September-delivery natural rubber in Shanghai dropped 0.9 percent to trade at 35,560 yuan ($5,422) a

ton at the 11:30 a.m. local time break, paring declines of as much as 1.7 percent.

China’s Hainan province, the country’s biggest producer, will start tapping rubber trees in late

March, Zhang Bei, analyst at Nanhua Futures Co., said yesterday. “So domestic supply will be on

the rise as those Hainan produce is coming on stream,” Zhang said.

Rubber in Tokyo on March 15 fell to 335 yen, the lowest level since Nov. 4 as worsening Middle East

tensions and slowing car sales in China raised concerns demand may decline. Losses intensified after

the massive earthquake in Japan.

By Bloomberg News - Mar 25, 2011 4:09 AM GMT

http://www.bloomberg.com/news/2011-03-25/rubber-declines-on-concern-demand-may-fall-amid-china-polic

y-tightening.html

Rubber in Tokyo declined, paring a weekly gain, on concern demand from China, the biggest consumer,

may stall as the government continues to tighten monetary policy to rein in inflation.

The August-delivery contract on the Tokyo Commodity Exchange fell as much as 3.9 percent to 419.2

yen a kilo ($5,175 a metric ton) and traded at 429 yen by 12:55 p.m. local time. Futures have gained

5 percent this week, rallying to 446.9 yen on March 23, more than 33 percent higher than a

four-month low reached this month, after Thailand, Indonesia and Malaysia, the three biggest

producers, agreed in principle to delay exports if prices tumbled.

“The rally might fizzle out if the biggest buyer China doesn’t step up to the plate and start

buying in big volume,” Forest Hu, manager at the rubber department of PKU Founder Commodities

Group Co., said by phone from Shanghai today. “From here we can see that China’s tightening

looks set to continue so demand might be crimped.”

The central bank has raised interest rates three times since October to cool inflation that reached

4.9 percent in February, exceeding the government’s 4 percent annual target. It has boosted

banks’ reserve requirements nine times since the start of 2010, including an increase of half a

percentage point from today.

China’s consumer prices may rise about 5 percent in March from a year earlier, the China

Securities Journal reported today, citing a report by the pricing department of the National

Development and Reform Commission. Prices in the first quarter may have gained about 4.9 percent,

the report said.

China Supply

September-delivery natural rubber in Shanghai dropped 0.9 percent to trade at 35,560 yuan ($5,422) a

ton at the 11:30 a.m. local time break, paring declines of as much as 1.7 percent.

China’s Hainan province, the country’s biggest producer, will start tapping rubber trees in late

March, Zhang Bei, analyst at Nanhua Futures Co., said yesterday. “So domestic supply will be on

the rise as those Hainan produce is coming on stream,” Zhang said.

Rubber in Tokyo on March 15 fell to 335 yen, the lowest level since Nov. 4 as worsening Middle East

tensions and slowing car sales in China raised concerns demand may decline. Losses intensified after

the massive earthquake in Japan.

Alpha. Ton avis d'une phrase et, en chiffre ? Tu te positionnes ?

Conséquence séisme Japon : la Thailande suspend ses exportations de caoutchouc et achète pour

soutenir les cours.

LONDON CAOUTCH; 98.75 -12.05%

SIPH 86.52 -1.65% on va vers 79 puis 73, vente à découvert sans doute.

Conséquence séisme Japon : la Thailande suspend ses exportations de caoutchouc et achète pour

soutenir les cours.

LONDON CAOUTCH; 98.75 -12.05%

SIPH 86.52 -1.65% on va vers 79 puis 73, vente à découvert sans doute.

surveillez aussi certificat caoutchouc 1167 N, la MM 20 pique du nez, 29.56 + 1.13%, mais pourquoi

on ne retrouve pas les mêmes cours sur T.S. ?

on ne retrouve pas les mêmes cours sur T.S. ?

26/03/2011 par

Ancien16767

0

Sur SIPH?

Je ne la regarde pas, IG Index ne l'offrant pas sur la plateforme de trading.

Je suis ce que font les cours du caoutchouc car j'ai des Mimils (pre-tsunami et switch de Valeo sur

Mimil apres tsunami). Mais il est clair que la croissance des ventes automobiles a travers le monde

est en ralentissement cette annee (~ +5% en volume sur 2011(e), la presentation strategique de Valeo

debut mars peut servir de reference) et les pneus representent 70% des debouches du caoutchouc me

semble t'il (peut-etre a verifier avec SIPH).

La disruption au Japon de la prod automobile n'aide pas. Les usines japonaise de pneus n'ont pas

vraiment ete touchees industriellement mais la logistique locale semble le probleme. Sans mentionner

que les usines du Nord sont coupes du Sud a ma connnaissance, la ligne de chemin de fer passant par

la zone d'evacuation (voir mon post sur la logistique).

Retour sur le caoutchouc, les cours du palladium, dont debouche principal est dans les pots

catalytiques, n'a pas subit le meme retrait. Est-ce qu'il avait moins grimpe auparavant, ou

faut-il chercher l'explication non pas du cote de la demande mais de l'offre? Malheureusement

aucune idee, je ne trade pas les metaux.

Je suis content de voir que BASF a repris des couleurs, les valeurs industrielles/cycliques

allemandes se sont reprises en comparaison de celles des US.

Je ne la regarde pas, IG Index ne l'offrant pas sur la plateforme de trading.

Je suis ce que font les cours du caoutchouc car j'ai des Mimils (pre-tsunami et switch de Valeo sur

Mimil apres tsunami). Mais il est clair que la croissance des ventes automobiles a travers le monde

est en ralentissement cette annee (~ +5% en volume sur 2011(e), la presentation strategique de Valeo

debut mars peut servir de reference) et les pneus representent 70% des debouches du caoutchouc me

semble t'il (peut-etre a verifier avec SIPH).

La disruption au Japon de la prod automobile n'aide pas. Les usines japonaise de pneus n'ont pas

vraiment ete touchees industriellement mais la logistique locale semble le probleme. Sans mentionner

que les usines du Nord sont coupes du Sud a ma connnaissance, la ligne de chemin de fer passant par

la zone d'evacuation (voir mon post sur la logistique).

Retour sur le caoutchouc, les cours du palladium, dont debouche principal est dans les pots

catalytiques, n'a pas subit le meme retrait. Est-ce qu'il avait moins grimpe auparavant, ou

faut-il chercher l'explication non pas du cote de la demande mais de l'offre? Malheureusement

aucune idee, je ne trade pas les metaux.

Je suis content de voir que BASF a repris des couleurs, les valeurs industrielles/cycliques

allemandes se sont reprises en comparaison de celles des US.

26/03/2011 par

Ancien16767

0

Article recent sur les cours du caoutchouc et raison de la baisse, imputee au tour de vis de la

politique monetaire chinoise:

http://www.bloomberg.com/news/2011-03-25/rubber-declines-on-concern-demand-may-fall-amid-china-polic

y-tightening.html

Rubber Declines on Concern Demand May Fall Amid China Policy Tightening

By Bloomberg News - Mar 25, 2011 4:09 AM GMT

Rubber in Tokyo declined, paring a weekly gain, on concern demand from China, the biggest consumer,

may stall as the government continues to tighten monetary policy to rein in inflation.

The August-delivery contract on the Tokyo Commodity Exchange fell as much as 3.9 percent to 419.2

yen a kilo ($5,175 a metric ton) and traded at 429 yen by 12:55 p.m. local time. Futures have gained

5 percent this week, rallying to 446.9 yen on March 23, more than 33 percent higher than a

four-month low reached this month, after Thailand, Indonesia and Malaysia, the three biggest

producers, agreed in principle to delay exports if prices tumbled.

“The rally might fizzle out if the biggest buyer China doesn’t step up to the plate and start

buying in big volume,” Forest Hu, manager at the rubber department of PKU Founder Commodities

Group Co., said by phone from Shanghai today. “From here we can see that China’s tightening

looks set to continue so demand might be crimped.”

The central bank has raised interest rates three times since October to cool inflation that reached

4.9 percent in February, exceeding the government’s 4 percent annual target. It has boosted

banks’ reserve requirements nine times since the start of 2010, including an increase of half a

percentage point from today.

China’s consumer prices may rise about 5 percent in March from a year earlier, the China

Securities Journal reported today, citing a report by the pricing department of the National

Development and Reform Commission. Prices in the first quarter may have gained about 4.9 percent,

the report said.

China Supply

September-delivery natural rubber in Shanghai dropped 0.9 percent to trade at 35,560 yuan ($5,422) a

ton at the 11:30 a.m. local time break, paring declines of as much as 1.7 percent.

China’s Hainan province, the country’s biggest producer, will start tapping rubber trees in late

March, Zhang Bei, analyst at Nanhua Futures Co., said yesterday. “So domestic supply will be on

the rise as those Hainan produce is coming on stream,” Zhang said.

Rubber in Tokyo on March 15 fell to 335 yen, the lowest level since Nov. 4 as worsening Middle East

tensions and slowing car sales in China raised concerns demand may decline. Losses intensified after

the massive earthquake in Japan.

26/04/2011 par

Ancien16767

0

La conference call de ML etait tres positive, que ce soit sur les hausses de prix, l'importance

somme toute moderee du restockage dans la hausse du CA, la supply chain au Japon, etc,...Deutsche

Bank vient de revoir a la hausse sa price target a €90 (qui sait, pourquoi pas?),...

De l'autre cote Valeo, apres avoir ouvert en hausse sur les ventes excellentes de Michelin -

probablement poussee par les pp - s'est rapidemment reajustee a la baisse sur la production

d'avril attendu en baisse de 60% par Nissan au Japon. A noter que Johnson Controls a fait un sales

warning hier, lie au Japon et a perdu 2.8%. L'auto hors batteries represente moins de la moitie du

CA de JCI.

Je conserve mon exposition sur ML et me repositionnerai sur Valeo - vendue le mois dernier - lorsque

la visibilite s'ameliorera.

Bons trades

somme toute moderee du restockage dans la hausse du CA, la supply chain au Japon, etc,...Deutsche

Bank vient de revoir a la hausse sa price target a €90 (qui sait, pourquoi pas?),...

De l'autre cote Valeo, apres avoir ouvert en hausse sur les ventes excellentes de Michelin -

probablement poussee par les pp - s'est rapidemment reajustee a la baisse sur la production

d'avril attendu en baisse de 60% par Nissan au Japon. A noter que Johnson Controls a fait un sales

warning hier, lie au Japon et a perdu 2.8%. L'auto hors batteries represente moins de la moitie du

CA de JCI.

Je conserve mon exposition sur ML et me repositionnerai sur Valeo - vendue le mois dernier - lorsque

la visibilite s'ameliorera.

Bons trades

Salut Alpha,

Je me disais avec ce UP Alpha va réagir.

ML se dirige sans doute vers les 70; et peut dépasser largement en tant que valeur solide, si l'on

regarde ses antécédents.

Je ne peux m'empêcher de comparer avec SIPH :

ML oscille vers les 53/55 du 23/11 au 31.01, ce jour à 66 +24.5% et à 70 plus tard + 32%

SIPH ses derniers plus bas sur support 77.60 le 15/03, ce jour à 98.80 + 27.31% se dirige vers

109.5 + 41.10%

Bons % à M.T.

Je me disais avec ce UP Alpha va réagir.

ML se dirige sans doute vers les 70; et peut dépasser largement en tant que valeur solide, si l'on

regarde ses antécédents.

Je ne peux m'empêcher de comparer avec SIPH :

ML oscille vers les 53/55 du 23/11 au 31.01, ce jour à 66 +24.5% et à 70 plus tard + 32%

SIPH ses derniers plus bas sur support 77.60 le 15/03, ce jour à 98.80 + 27.31% se dirige vers

109.5 + 41.10%

Bons % à M.T.

26/04/2011 par

Ancien16767

0

Salut Antares,

C'est la fin des vacances scolaire ici au Royaume-Uni et la fin du beau temps, donc retour sur les

marches sur les trois jours (vendredi marche UK ferme cause mariage). Et rattrapage sur les

nouvelles. Mais il est vrai que le mois d'Avril a ete favorable.

Loockheed, 3M, Ford, Coke, UPS, ITW, GE, sans compter Johnson Controls - que j'ai en position short

pour des raison de valorisation. Ils vont probablement rebondir sur les resultats de Ford. Mais la

conference call de JCI a souleve des questions interessantes. Je vais rejeter un coup d'oeil sur

Schneidre.

Quant a Michelin, qu'elle fasse +4% en un jour ou +1% sur quatre jours m'importe peu. En fait, je

prefere une appreciation progressive a des a-coups a la hausse ou a la baisse.

Bien vu sur SIPH. Quel est ton investment case?

C'est la fin des vacances scolaire ici au Royaume-Uni et la fin du beau temps, donc retour sur les

marches sur les trois jours (vendredi marche UK ferme cause mariage). Et rattrapage sur les

nouvelles. Mais il est vrai que le mois d'Avril a ete favorable.

Loockheed, 3M, Ford, Coke, UPS, ITW, GE, sans compter Johnson Controls - que j'ai en position short

pour des raison de valorisation. Ils vont probablement rebondir sur les resultats de Ford. Mais la

conference call de JCI a souleve des questions interessantes. Je vais rejeter un coup d'oeil sur

Schneidre.

Quant a Michelin, qu'elle fasse +4% en un jour ou +1% sur quatre jours m'importe peu. En fait, je

prefere une appreciation progressive a des a-coups a la hausse ou a la baisse.

Bien vu sur SIPH. Quel est ton investment case?

27/04/2011 par

Ancien16767

0

Une comparaison rapide avec l'article du 8 mars, repris dans un de mes posts montre que TOYO,

Hankook, GT, Yokohama, Bridgestone et Michelin ont passe ou annonce de nouvelles hausses depuis.

L'article est tout recent, en date du 25 avril

April 25, 2011

In the raw: materials are up, so are Toyo's prices

Effective May 1, 2011, Toyo Tire U.S.A. Corp. will increase prices on all commercial tires by up to

15% with in-line adjustments. Toyo says the increase is due to a continued escalation in raw

material costs.

“Due to the steep increase in the costs of raw materials affecting our industry, we must

reluctantly raise prices of our product,” says John Hagan, senior director, sales, Toyo Tire

U.S.A. Corp. “We appreciate the continued support and understanding of our dealers as we remain

committed to providing the highest quality products.”

Toyo is the latest company to raise prices so far this year.

Consumer

* Goodyear Tire & Rubber Co. is raising consumer tire prices for the second time in two months,

effective May 1, Goodyear will increase prices on all its replacement passenger and light truck

tires in North America up to 8%. The company already raised price on March 1.

* Yokohama Rubber Co. Ltd. applied an increase up to 15% on all passenger and light truck tires

exported outside Japan in early April. That follows Yokohama Tire Corp.'s price increase (up to 8%)

on all of its consumer tires on March 1.

* Michelin North America Inc. will be increasing prices up to 8.5% on Michelin, BFGoodrich, Uniroyal

and private and associate passenger and light truck replacement tires sold in the United States. The

prices will go into effect May 1. Michelin also raised prices on Feb. 1; the increases varied by

product line.

(Michelin also announced it was raising Michelin and BFGoodrich passenger and light truck winter

replacement tires sold in Canada by up to 7% on April 1.)

* Nexen Tire America Inc. raised tire prices up to 8% on April 1. The increases applied to warehouse

orders and April FDC production. Nexen also raised prices "up to 8%" on Jan. 1.

* Toyo Tire U.S.A. Corp. increased prices on passenger and light truck tires by an average of 8%,

with in-line adjustments, effective March 1.

* Hankook Tire America Corp. increased prices on its full line of passenger and light truck tires by

a weighted average of 7%. The increases went into effect April 1.

* Cooper raised prices on its light vehicle tires on March 15. The increases in total averaged

around 8% to 9%, with in-line adjustments.

* Continental Tire the Americas LLC raised consumer tire prices in the U.S. up to 6%, with some

in-line adjustments, on April 1.

* Federal Corp. raised prices on its passenger and light truck tires by up to 12% effective March 1.

The percentage increase varied by product lines and continents. There also were in-line adjustments

for all onward orders and remaining back orders.

* Kumho Tire U.S.A. Inc. raised prices on all passenger, light truck and medium truck tires

effective March 1. Kumho says the details of this increase will be provided to its customers in the

near future.

* Falken Tire Corp. also raised prices on March 1. The price hikes on Falken passenger and light

truck tires ranged from 5% to 8% depending on the size, with in-line adjustments as needed.

* Bridgestone Americas Tire Operations LLC raised replacement and original equipment consumer tire

prices on April 1, The increases on Bridgestone, Firestone and associate brand passenger and light

truck tires in the U.S. and Canada varied up to 8%.

Commercial

* Yokohama Tire Corp. will implement price increases of up to 10% on all of its off-the-road (OTR)

tires in the United States, effective May 1, 2011.

Yokohama implemented a price increase on all of its light and medium commercial truck tires in the

United States on April 1. Prices were raised an average of 8%, with in-line adjustments.

(Yokohama Rubber applied an up to 15% increase on its truck and bus tires exported outside Japan in

early April.)

* Michelin will increase prices on Michelin brand earthmover replacement tires sold in the United

States and Mexico by up to 8% effective May 1. It will be the second increase this year; the company

already increased prices on its earthmover (and industrial) replacement tires sold in North America

up to 7% on Feb. 1.

Michelin increased prices on Michelin brand replacement agricultural tires sold in the U.S. and

Canada on March 1. The hikes were up to 8%.

The company also raised prices an average of 12% on Michelin and BFGoodrich truck tires and Michelin

Retread Technologies and Oliver retread products. on March 1. It first raised prices on Oliver and

MegaMile retread rubber products sold in the U.S. up to 7% on Jan. 3.

(Michelin also is raising prices on its Michelin and BFGoodrich truck tires sold in Canada up to 7%

on April 1.)

* Goodyear Tire & Rubber Co. raised prices on its commercial truck tires on April 1. The increases

applied to all the company's brands, plus its tread rubber.

The increases were as follows: up to 15% on truck tires; up to 7% on tread rubber.

* Continental increased the price of its Continental, General and AmeriSteel brand truck tires by

10% on April 1 for replacement sales channels in the U.S. only.

* Double Coin and China Manufacturers Alliance LLC (CMA) hiked commercial tire prices an average of

13% on March 1. The price increases applied to the Double Coin radial truck and bus tires, all of

its private brand radial truck and bus tires, and Double Coin radial off-the-road tires.

* Toyo increased prices on its commercial truck and OTR tires by an average of 8%, with in-line

adjustments, on March 1.

* Hankook increased prices on its medium truck tires by a weighted average of 9%. The increases went

into effect on tire shipments made on or after March 15.

* Titan Tire Corp. raised prices on its farm and construction tires on April 1. The increases, up to

8%, applied to both Titan branded products and Goodyear branded tires manufactured by Titan.

* Cooper Tire raised its commercial truck tire prices 12% across the board during the week of Feb.

6, 2010.

* The Bridgestone Off Road Tire, U.S. & Canada Commercial Tire Sales division increased prices on

its mining, construction and industrial tires by 12%, "with some in-line adjustments" on March 1.

* The Bridgestone Agricultural Tire, U.S. & Canada Commercial Tire Sales division implemented a 4%

price increase on April 1 on the following tires: Firestone agricultural, construction and forestry

tires; Bridgestone garden tires; and Regency tires sold in the United States and Canadian

replacement markets.

CGS Tyres Group (7.5% to 10% on farm and industrial tires), Titan Tire (up to 8% on farm and OTR

tires), Yokohama Tire Corp. (up to 5% on bias and radial OTR tires) and Continental Tire the

Americas (up to 8% on truck tires) raised their commercial tire prices on Jan. 1.

Hankook, GT, Yokohama, Bridgestone et Michelin ont passe ou annonce de nouvelles hausses depuis.

L'article est tout recent, en date du 25 avril

April 25, 2011

In the raw: materials are up, so are Toyo's prices

Effective May 1, 2011, Toyo Tire U.S.A. Corp. will increase prices on all commercial tires by up to

15% with in-line adjustments. Toyo says the increase is due to a continued escalation in raw

material costs.

“Due to the steep increase in the costs of raw materials affecting our industry, we must

reluctantly raise prices of our product,” says John Hagan, senior director, sales, Toyo Tire

U.S.A. Corp. “We appreciate the continued support and understanding of our dealers as we remain

committed to providing the highest quality products.”

Toyo is the latest company to raise prices so far this year.

Consumer

* Goodyear Tire & Rubber Co. is raising consumer tire prices for the second time in two months,

effective May 1, Goodyear will increase prices on all its replacement passenger and light truck

tires in North America up to 8%. The company already raised price on March 1.

* Yokohama Rubber Co. Ltd. applied an increase up to 15% on all passenger and light truck tires

exported outside Japan in early April. That follows Yokohama Tire Corp.'s price increase (up to 8%)

on all of its consumer tires on March 1.

* Michelin North America Inc. will be increasing prices up to 8.5% on Michelin, BFGoodrich, Uniroyal

and private and associate passenger and light truck replacement tires sold in the United States. The

prices will go into effect May 1. Michelin also raised prices on Feb. 1; the increases varied by

product line.

(Michelin also announced it was raising Michelin and BFGoodrich passenger and light truck winter

replacement tires sold in Canada by up to 7% on April 1.)

* Nexen Tire America Inc. raised tire prices up to 8% on April 1. The increases applied to warehouse

orders and April FDC production. Nexen also raised prices "up to 8%" on Jan. 1.

* Toyo Tire U.S.A. Corp. increased prices on passenger and light truck tires by an average of 8%,

with in-line adjustments, effective March 1.

* Hankook Tire America Corp. increased prices on its full line of passenger and light truck tires by

a weighted average of 7%. The increases went into effect April 1.

* Cooper raised prices on its light vehicle tires on March 15. The increases in total averaged

around 8% to 9%, with in-line adjustments.

* Continental Tire the Americas LLC raised consumer tire prices in the U.S. up to 6%, with some

in-line adjustments, on April 1.

* Federal Corp. raised prices on its passenger and light truck tires by up to 12% effective March 1.

The percentage increase varied by product lines and continents. There also were in-line adjustments

for all onward orders and remaining back orders.

* Kumho Tire U.S.A. Inc. raised prices on all passenger, light truck and medium truck tires

effective March 1. Kumho says the details of this increase will be provided to its customers in the

near future.

* Falken Tire Corp. also raised prices on March 1. The price hikes on Falken passenger and light

truck tires ranged from 5% to 8% depending on the size, with in-line adjustments as needed.

* Bridgestone Americas Tire Operations LLC raised replacement and original equipment consumer tire

prices on April 1, The increases on Bridgestone, Firestone and associate brand passenger and light

truck tires in the U.S. and Canada varied up to 8%.

Commercial

* Yokohama Tire Corp. will implement price increases of up to 10% on all of its off-the-road (OTR)

tires in the United States, effective May 1, 2011.

Yokohama implemented a price increase on all of its light and medium commercial truck tires in the

United States on April 1. Prices were raised an average of 8%, with in-line adjustments.

(Yokohama Rubber applied an up to 15% increase on its truck and bus tires exported outside Japan in

early April.)

* Michelin will increase prices on Michelin brand earthmover replacement tires sold in the United

States and Mexico by up to 8% effective May 1. It will be the second increase this year; the company

already increased prices on its earthmover (and industrial) replacement tires sold in North America

up to 7% on Feb. 1.

Michelin increased prices on Michelin brand replacement agricultural tires sold in the U.S. and

Canada on March 1. The hikes were up to 8%.

The company also raised prices an average of 12% on Michelin and BFGoodrich truck tires and Michelin

Retread Technologies and Oliver retread products. on March 1. It first raised prices on Oliver and

MegaMile retread rubber products sold in the U.S. up to 7% on Jan. 3.