Last year, Orco Property Group took control of AQ Okna (manufacturing of building windows) (on 14th

May 07, Private Equity Fund, managed by ORCO Holding, has joined the AQ Okna company ;

http://www.orcogroup.com/Files/nastenka/page_4945/Version1/ORCO_eNEWS_May2007.pdf )

and later acquired VPO Protivanov and Polish group Trion active in the field. J-F Ott wanted to form

a group of all these companies.

However, this morning, the news went out that AQ Okna was initiated before the court

by Saint Gobain Glass Czech Republic to be declared bankrupt and this while the debts at the origin

of this insolvency procedure amounted only 18 Mio CZK (720 000 EUR) !

Source:

http://ekonomika.idnes.cz/vyznamna-okenarska-firma-aq-okna-je-v-insolvencnim-rizeni-kvuli-dluhum-132

-/ekonomika.asp?c=A081203_135242_ekonomika_vem

J-F Ott lost also heavily on Orc Property Group and on his Novy Fund

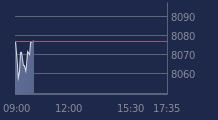

Roughly calculated, at the end of 2005, ORC quoted at about 60 EUR.

So, the loan he took with his shares of ORC as collateral amounted to about 66 Mio EUR.

Recently (since Aug 13, 08 - J-F Ott had to sell approximately 1.176 Mio of shares for a value

of about 14.1 Mio EUR.

So, J-F Ott lost 51.9 Mio EUR (making abstraction of any profits or losses he made in the period

of end 2005 and Oct 20, 08 out of possible trading). ...

I see on the Novy Fund:

...

� Founded in April 2006 by Jean Francois Ott (CEO of Orco Group) and AMM Finance(Geneva)

� Around € 50 million ($ 63 million) assets under management

� Return since inception is 5.34% for Euro class and 5.44% for USD class

Data in EUR mn 2005 2006 2007

Revenue 33,2 40,5 72,2

Growth y/y 21,9% 78,4%

EBITDA 3,7 5,1 8,6

EBITDA margin 6,6% 8,1% 8,7%

Net profit 1,8 2,8 4,7 <---------------

P/E 40,5 26,0 15,9

EV/EBITDA 17,9 13,1 7,7

...

(Source: http://www.novyfund.com/img/Presentation_October_08.pdf )

Remark however ! :

...

October was also Novy fund’s worst month ever with nearly 20% losses from September

... Performance ( EUR in %) 1 Year (Rolling) = -29.99 !!

... Performance ( USD in %) 1 Year (Rolling) = -38.97 !!

... See also : http://www.postimage.org/image.php?v=aV1gxpx9

(Source: http://www.novyfund.com/img/Reporting_EUR_October_08.pdf )

I'll have a further look in it, but it looks as if J-F Ott not only lost 51.9 Mio EUR

on the sales of ORC, but is also losing heavily on his Novy Fund (30%). So, not only has

he been forced to sell his part in Orco Property Group, but he is way in the red with the Novy Fund.

And now there is the initiating of the bankruptcy procedure of AQ Okna and this

for a relative small amount !

All in all, this must be very unhealthy for the trust investors put in his knowledge and ability !

Concerning 'European Investors', if they are what I found, then they are mostly

US based investors in mainly real estate companies. So, I would be surprised that

they aim at actively be involved in the management of ORC or in the complete takeover

of control of ORC.

http://www.euroinv.com/

http://www.euroinv.com/realestatesecurities/

http://www.euroinv.com/contact/

And then I read that:

...

According to Jones Lang LaSalle, overall real estate investment volume dropped in all CE countries

in 1H 08 with the deepest decrease in Hungary (-68%) and the Czech Republic

(-64%), while Poland saw a drop of 40% y/y.

The real estate sector in Central Europe is dependent on foreign investment. In 1H 08, domestic

investment was responsible for only 6% of total real estate investments in both Poland and the Czech

Republic, according to CB Richard Ellis. This implicates how the financial crisis spread to the CE

regional real estate markets despite there weren’t many signs of local economies’ problems (with

the notable exception of Hungary) until Q3 08. ...

Source: http://trading.kb.cz/ibweb/analysisDetail.do?ID=5719

Add finally to all this that J-F Ott has the vast amount of his share in Orc Property Group

wíthout notifying the Authorités des Marchés Financières (AMF) in due time ...