Orco: 3Q08 results below expectations

(Source: KBC Securities/Patria - MORNING CALL 28 November 2008)

Orco: 3Q08 results below expectations

Orco reported its 3Q08 results on Thursday, 27 November.

Net profit after minorities came in at a loss of € 15.7m, versus a profit of € 13.3m in 3Q07, a

profit of € 11.3m in 2Q08 and our expectations of € 1.0m profit.

Results are below market expectations (according to Bloomberg consensus).

The company cut its 2008 turnover target from € 343m to € 300m (our

expectations stood at € 329m) mainly on the back of lower commercial

development sales and lower commissions from Endurance Fund, lowered 2009 capex to € 300m (our

expectations stood at € 450m), and announced a program for cutting operating expenses by 25%.

Given below estimates results and dimmer outlook for 2009, we see the news as negative.

Total sales came in at € 112.3m, 32.0% higher y/y, 69.8% higher q/q and

32.2% above our expectations. The results were influenced positively by

the development activity where the company continued delivery based on

FPCs signed previously and disposal of Avenue Gardens.

EBITDA (excl. revaluations) came in at € 12.1m, down 0.8% y/y, down

0.5% q/q and 40.5% below our expectations.

Negative influences came from operating expenses above our expectations at staff costs level and

other overhead costs while a gain of € 13m net gain of assets disposals contributed positively.

EBIT including revaluation came in at € 13.4m, up 38.1% y/y, down

29.9% q/q and 25.3% below our expectations.

Revaluation gains were not significant in this quarter.

Net financial result came in at € 34.2m loss, 57.3% higher y/y and

94.1% higher than our expectations.

The main difference comes from a € 21m non-cash amortization of repayment premiums and embedded

derivatives.

According to management, this is related to an option linked to

the stock price of the company measuring the probability of default.

Excluding this one-off, financial loss would have been 25.1% below our

expectations.

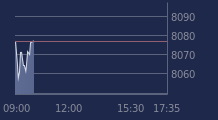

Overview, see:

http://www.postimage.org/image.php?v=Pq24V8oi

Combien de posts va-t'il faire? Il est capable de faire toute la page!

QUAND JE DISAIS QU'IL ETAIT BIEN ATTEINT !!!

le pire c'est qu'il persevére avec ces posts qu'ils ne veulent rien dire et incomprehensible!!!

ça relève de la psychatrie!!si!si!!

Orco: perte nette pour le 9M08 légèrement au-dessus des attentes, réduit les perspectives de

vente

Autor: Vladimír Urbánek (Kurzy.cz) 28.11.2008 10:20:55

Patrick Vyroubal - Atlantik FT

Source:

http://translate.google.com/translate?u=http%3A%2F%2Fwww.kurzy.cz%2Fzpravy%2F158377-orco-cista-ztrat

a-za-9m08-lehce-nad-ocekavanimi-snizeny-vyhled-trzeb%2F%26usg%3DALkJrhjVTwbM54brI0KUKc6AXT86b2aFLQ&h

l=en&ie=UTF-8&sl=cs&tl=fr

@ Yoda & Oscar: Si vous ne comprenez que le Français, ça doit donc être très difficile de suivre

une entreprise qui n'a que des affaires en PL, DE, CS, HU, SL. N'est-ce pas ? Si vous êtes

intéressés par immobilier, je suggère les entreprise qui font des affaires en FR, comme Nexity,

Les Nouveaux Constructeurs, Kaufman & Broad et tant d'autres. Oui même VM Materiaux, Groupe Vial,

Capelli. Ou, si vous voulez tout même un peu d'internationale: Vicat, Lafarge, Saint Gobain,

etc... Si vous voules discuter de immobilier hors de la France, alors là, vaut mieux être

polyglote.

Komercni Banka - Equity Research - Czech Breakfast - 28 Nov 08

http://www.postimage.org/image.php?v=Pq26mhl9

Source:

http://trading.kb.cz/ibweb/analysisDetail.do?ID=5772

ORCO PROPERTY GROUP

9M 08 results: EUR 30m loss and decreased 2008 revenue guidance

Source:

http://trading.kb.cz/ibweb/analysisDetail.do?ID=5773

ORC: Buy (ING WB; obj. 16 EUR)

BRIEF-ING revises ratings, targets on several EMEA real estate stocks

Dec 2 (Reuters) - EMEA real estate:

* ING cuts Ablon Group to hold from buy

* ING cuts Dom Development price target to 15.4 PLN from 37 PLN ; keeps hold rating

* ING cuts Eastern Property Holdings to hold from buy; target price to 21.6 USD from 90 USD

* ING raises GTC target price to 25.3 PLN from 21.4 PLN ; keeps buy rating

* ING cuts IMMOEAST to hold from buy; target price to 0.32 EUR from 20 EUR

* ING raises Orco Property Group to buy from hold; cuts target price to 16 EUR from 29 EUR

* ING cuts KDD Group to sell from buy

* ING cuts open investments price target to 38 USD from 287.9 USD ; keeps hold rating

* ING cuts pik to sell from hold

* ING cuts RTM to hold from buy

* ING cuts XXI Century to sell from hold

((Bangalore Equities Newsroom; +91 80 4135 5800; within U.S. +1 646 223 8780))

Distributed by Reuters Limited.