AG de Prodware aujourd'hui+

le CEO de Qurius a dit que les 2 CEO annonceraient "a major next step in the partnership"! voilà

l'article

demain au plus tard dixit PDG Qurius

Qurius secures €10 million equity line

Turn to more added value accelerated

AMSTERDAM, 16 June 2011 – Qurius announces that it has entered into a Standby Equity Distribution

Agreement (‘SEDA’) for a € 10 million equity line with YA Global Master SPV Ltd

(‘Yorkville’), the investment fund managed by Yorkville Advisors LLC. This strengthening of

capital will support the further cooperation between Prodware and Qurius. The extra funding will be

used by Qurius to invest in high margin activities - as in line with Qurius’ vision expressed in

2010 - and to support future working capital requirements and debt reduction.

---------------------------------------------------------------------- -- --------

Commenting on the SEDA agreement, Michiel Wolfswinkel, Chief Financial Officer of Qurius said: “We

are delighted to be announcing this standby arrangement for funds up to € 10 million. High margin

products and solutions are our future. This facility enables us to speed up our investments in the

development of such high margin activities without recourse to our operational cash flows.”

Brian Kinane, Yorkville’s Managing Director adds: “At Yorkville, we share the belief of Qurius

that the future of technology solution delivery will be better achieved through the combination of

cloud computing and products. We hope that our financing capabilities will assist Qurius in

achieving its strategic objectives.”

The SEDA with Yorkville further strengthens the strategic alliance between Qurius and Prodware. This

alliance proceeds very well as Qurius and Prodware are materializing a number of joint synergy

opportunities - such as joint engagement in client propositions, joint development activities,

reselling best of breed products and sharing resources. Within two weeks the presidents of both

companies will announce a major next step in the partnership.

The SEDA enables Qurius to intensify the development of front end applications based on Qurius’

existing customer expertise in defined mid market verticals. Successful projects in this domain are

undertaken already, and can now be accelerated. Solutions that will be developed with the now

available additional funding will also be sold and distributed through the Qurius global alliance.

The SEDA also allows Qurius to reposition its existing loan facility with NIBC.

Under the terms of the SEDA, Qurius - at its sole discretion - has the right, not the obligation, to

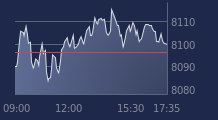

place shares, with Yorkville over a period of up to three years. The shares issued by Qurius will be

at a 3% discount to the prevailing market price during the ten trading days pricing period of each

draw down (following the draw down request). Qurius may also set a minimum price for each draw down.

The maximum advance that may be requested is 200% of the average daily trading volume of the Qurius

shares (denominated in Euro) of the ten trading days prior to the draw down request, or € 200.000,

whichever is higher. The facility may be drawn down upon once every ten trading days.

Yorkville will receive an implementation fee of € 300.000 for the provision of this SEDA facility,

which will be payable on or before October 1, 2011 either in cash or from the proceeds of the first

drawn down under the facility. Furthermore, Yorkville will receive a 3% commission on each draw

down.

Qurius intends to use the exemption provided by paragraph 2 of article 53 of the Exemption

regulation of the Financial Supervision Act (Vrijstellingsregeling Wft, art. 52 lid 2), that allows

for issuing shares for an aggregate amount of up to € 2.5 million during a period of 12 months.

The shares will be issued under the authority granted by shareholders meeting of Qurius to issue up

to 10% of the issued share capital of the company for general purposes, while pre-emption rights

from existing shareholders will be excluded.