agarwal rachete les minos et retrait de la cote avec une prime de 30%

Vedanta Surges as Billionaire Founder Agarwal Plans Buyout

By Swansy Afonso

and Mark Burton

2 juillet 2018 à 03:39 UTC−3 Updated on 2 juillet 2018 à 05:28 UTC−3

Vedanta will recommend all-cash offer of 825p from Volcan

London listing no longer necessary to access capital

Vedanta Resources Plc surged by a record after billionaire shareholder Anil Agarwal said he’ll offer to buy out minority investors as part of efforts to streamline the Indian commodities group’s structure.

Agarwal, whose Volcan Investments Ltd. already owns 66.5 percent of Vedanta, intends to cancel the company’s London listing as it no longer needs to rely on the access to U.K. capital, it said in a statement Monday. The billionaire, who is also mining giant Anglo American Plc’s biggest shareholder, has made a series of moves to consolidate Vedanta’s holdings, including a merger with Cairn India Ltd. last year.

The offer, which values Vedanta Resources at 2.33 billion pounds ($3.1 billion), follows a tumultuous few months for the commodities group. Its shares plunged in May as Vedanta Ltd., in which the London-listed company owns just over 50 percent, was forced to shut a copper smelter in southern India following deadly protests. Earlier this year, a court ordered a halt to iron ore mining in Goa on environmental concerns.

Read more about Agarwal’s ambitious plans for Vedanta

Vedanta will recommend a cash offer from Volcan of 825 pence a share, the company said in a statement Monday. The offer is a premium of 14 percent to Vedanta’s three-month volume weighted average price, it said. Shareholders will also be entitled to a previously announced dividend of $0.41 per Vedanta share.

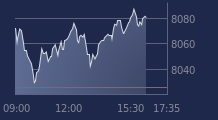

Vedanta Resources jumped as much as 28 percent to 828.8 pence on Monday, the biggest gain since its listing in 2003. The stock traded at 821.8 pence at 9:09 a.m. in London.

While the offer is a 28 percent premium to Friday’s closing price, Vedanta’s shares were trading above 850p before the drop in May.

“It’s not full value,” said Tim Huff, director of equity research at Canaccord Genuity Ltd. “But it’s a relatively good outcome.”