Evidemment, on est tous a constater qu'il n'a pas plu depuis des lustres, donc c'est le moment

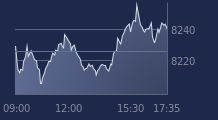

d'acheter sur le marche du ble peut on se dire. La tonne se traite sur le Paris Euronext Futures

Novembre 2011 a pres des 240 €/T. La France est le deuxieme exportateur modiale.

http://www.terre-net.fr/homepage/article-agritel-annonce-une-baisse-historique-des-rendements-du-ble

-tendre-1395-70784.html

J'ai personnellement hesite a semaine derniere a me positionner a l'achat mais y ai renonce au

regard du sell-off sur les commodities en general.

Goldman Sachs a recemment rehausse ses perspectives a 8$ / bushel - qui correspond au cours actuel.

Quelqu'un sur ce forum aurait-il des vue?

Goldman Sachs:

Goldman lifts wheat price hopes as crops struggle

Goldman Sachs, citing the risk of "adverse weather" to wheat production, has lifted its forecast

for prices of the grain in a report which also noted "upside" for corn and soybean prices.

The investment bank, whose warning last month over lower prices of oil and metals was viewed as a

key prompt for a slide in commodity prices, said that world wheat production was being

"jeopardised" by dry weather in many winter wheat areas, and wet conditions slowing North American

sowings.

"Dry conditions in Europe and China are offsetting higher Ukraine planted acreage, and uncertainty

remains high both on the potential size of the Russian winter wheat harvest," the bank said.

"While wheat planting intentions came in higher than expected in Canada, planting progress in

Western Canada is already well delayed."

These had limited the prospects for higher production, and "risks are for further downgrades should

weather conditions fail to improve".

Price prospects

Goldman lifted to $8.00 a bushel, from $7.75 a bushel, its forecast for wheat prices in three months

time, with the forecast for a year hiked by $0.85 to $8.35 a bushel.

The raised forecasts, nonetheless, remain below prices suggested by the futures curve, which has

Chiacgo's May 2012 contract at $9.26 a bushel.

Goldman has been more downbeat than many other observers on wheat prices, citing relatively abundant

stocks both in the US and the world, where it foresees inventories edging higher to 184.0m tonnes,

on the back of a 672.0m-tonne harvest, an estimate in line with many other observers.

The bank's comments come as the US Department of Agriculture is preparing later to release its

first full list of crop estimates for 2011-12 in the latest edition of its monthly Wasde crop supply

and demand report, regarded as the sector bible.

And they echo a report on Tuesday from Standard Chartered analyst Abah Ofon, who acknowledged that

the poor northern hemisphere weather had "elevated" risks to a bearish call on wheat prices, which

he sees averaging $7.70 a bushel in the July-to-September quarter.

'Growing risks'

However, Goldman remained upbeat on prospects for corn and soybean prices, despite question marks

over US export prospects for both crops.

For corn, the bank cut its forecast for shipments, "thanks to a recent slowdown in export sales",

but voiced scepticism over expectations that livestock farmers will substitute significant

quantities of wheat for expensive corn, as many observers, include the USDA, have suggested.

"While we believe that a corn-to-wheat feed switch is achievable, it is too early to call given

both rising wheat production uncertainty and growing risks that the corn harvest is delayed."

Furthermore, Goldman forecast "only a small build" in US corn inventories in 2011-12, seeing them

end the year at a thin 707m bushels, thanks to a wet spring which has delayed sowings and lowered

yield expectations.

Export competition

For soybeans, the bank flagged hits to US exports from "lacklustre" Chinese imports and the

prospect of "elevated" South American inventories, following good results from newly finished

harvests, lasting into the autumn.

"As a result, when the 2011-12 new crop begins on September 1, high Argentine and Brazilian stocks

from the 2010-11 harvest will compete for exports with the freshly harvested US 2011-12 crop."

However, US production is likely to fall next year, by some 45m bushels to 3.28bn bushels, thanks to

lower sowings as farmers switch to corn and cotton.

"On net, our expectation for a tighter soybean balance leads us to expect upside relative to the

forward curve," Goldman said.

Pour mon info

http://ec.europa.eu/agriculture/analysis/tradepol/worldmarkets/outlook/2010_2019_en.pdf