http://www.zccm-ih.com.zm/provisional-abridged-f inancials-fye-31-mar-18/

Commentary

• The Group reported a profit of K975 million (2017: K 729 million) representing 33% increase, driven

by improved production volumes of copper in most of ZCCM-IH’s investee companies and an

upsurge in copper prices during the year. London Metal Exchange copper price increased by

14.8% to US$ 6,724/ton (2017: US$5,858/ton) during the year.

• The Group recorded an operating loss of K130 million (2017: profit K848 million) mainly due to

Ndola Lime Company Limited’s (Subsidiary) continued loss-making position, which contributed

an operating loss of K167 million (2017: K1,152 million) during the year. Additionally, the

impairment of the investment in Konkola Copper Mines Plc amounting to K218 million increased

the recorded operating loss during the year.

• The Group recorded a positive share of profit from equity accounted investee companies of

K 689 million (2017: loss K 189 million). This movement represents 464% increase.

• Profit after tax was K 975 million (2017: K 729 million).

• The Group’s total assets increased by 13% from K9, 579 million (2017) to K10, 865 million (2018) on

account of increase in the net assets of investee companies whose performance continued to

improve during the year.

Subsequent events

Investrust Bank Plc

Subsequent to the year-end, ZCCM-IH Plc concluded a Mandatory Offer to the minority shareholders of

Investrust Bank Plc that took place from 9 to 30 April 2018. ZCCM-IH Plc acquired a further 2,125,890

shares, representing a 26.00% shareholding in Investrust Bank Plc. The mandatory offer increased ZCCMIH’s

shareholding in the Bank from 45.4% to 71.40%.

ZCCM Investments Holdings Plc (ZCCM-IH) as the majority shareholder has embarked on recapitalisation

and restructuring plans to make the Bank more competitive and better positioned to maximise returns

for its shareholders.

Ndola Lime Company Limited

Subsequent to the year end, two (2) former employees of Ndola Lime Company Limited (NLC)

employees instituted proceedings to the High Court of Zambia to place NLC under supervision pursuant

to the Corporate Insolvency Act No. 9 of 2017. By order of the Court dated 5th October 2018, the Official

Receiver was appointed as Interim Business Administrator of NLC.

The application for the Business Rescue Proceedings will be heard in January 2019 at which all affected

persons (including ZCCM-IH) will be heard.

However, ZCCM-IH remains committed to the affairs of NLC and will continue to pursue all activities that

better the Company and ZCCM-IH’s investment.

Outlook

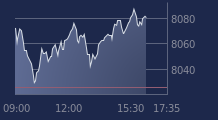

ZCCM-IH’s performance is expected to continue improving in light of continued improvement in copper

prices which drives the performance of most investee companies in the mining sector.

Résus publiés depuis longtemps.

Inutile de reposter.

Le cash se fait rare dans les résus, tu as vu ?

C'est une manip comptable, rien de plus.

Respire un bon coup waza. Regarde les lignes cash et held to maturity avant d’affirmer que les caisses sont vides....

La question que je me pose c'est dividende ou pas au titre de l'exercice clôturé le 31/03/2018 ?

Des avis à ce sujet ?

Oui, il y aura un dividende pour l'exercice 2017-2018.

Un peu plus élevé que celui que l'on vient de toucher (2016-2017).

L'AG est prévue pour fin février, début mars 2019.

Sans l'AG pour valider le div, pas de paiement.

Manip comptable pour satisfaire IDC

Foyer de pertes récurrents en cours de traitement (N'Dola et Investrust)

Il est grand temps de s'occuper des majos qui nous spolient depuis des lustres.