Indian billionaire Anil Agarwal sells Anglo stake

Reuters Reuters

Thursday July 25, 2019 1:20 PM

Kitco News

* Anglo shares have almost doubled since March 2017

* Anglo American declines to comment

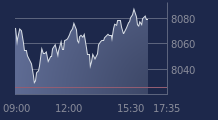

* Agarwal says urged Anglo to seize Indian opportunties (Adds context, Anglo no comment) LONDON, July 25 (Reuters) - Indian billionaire Anil Agarwal, the biggest shareholder in mining company Anglo American , said on Thursday he was divesting the nearly 20% stake he has held since 2017. Agarwal began buying into Anglo American through a JP Morgan mandatory convertible bond in March 2017 and announced he was buying a second tranche in September 2017, taking his holding in the mining group to a total of 19.3%. He would have had to make a decision next year on whether to buy the shares or seek to roll over the arrangement, which is effectively a loan. On Thursday, Agarwal said in a statement the targeted returns had been achieved "even sooner than expected" and Anglo American's share price had nearly doubled since he began his investment. He said he had encouraged Anglo to refocus on its South African operations and to position its business for "the many opportunities available in the rapidly growing Indian market". Anglo American on Thursday declined to comment. Earlier in the day it announced its strongest first-half earnings since 2011 and a $1 billion share buyback, its first since 2008. The bonds issued in 2017 financed a 3.5 billion pound ($1.25 billion) investment by Volcan, Agarwal's family trust.

After paying back the loan, Agarwal is left with a 1.9% stake in Anglo, which he is selling on the open market, industry sources said. Agarwal, who is chairman of Vedanta , has always said the stake was an investment, based on his belief in Anglo as a company, for his family trust. He said it was unrelated to Vedanta and he was not planning a takeover bid. ($1 = 0.8031 pounds) (Reporting by Barbara Lewis in London and Justin George Varghese in Bengaluru, additional reporting by Abhinav Ramnarayan. Editing by Jane Merriman and Kirsten Donovan)

L’homme d’affaires indien Anil Agarwal (photo) a annoncé, jeudi, qu’il cédait sa participation de 19,3% dans le géant minier Anglo American. Le milliardaire était l’actionnaire majoritaire de la compagnie depuis 2017, année au cours de laquelle il a réalisé à travers sa holding familiale Volcan Holdings, deux gros investissements de plus de 4 milliards $.

«Nos objectifs de rendement ont été atteints encore plus tôt que prévu. Le cours de l'action Anglo American a presque doublé depuis l'investissement de Volcan, offrant des gains attrayants à tous les investisseurs.», a déclaré M. Agarwal.

Depuis la première émission d’obligation pour l’investissement initial d’Agarwal en 2017, le cours des actions d’Anglo American a augmenté de 80% et le géant minier est maintenant évalué à 40 milliards $.

Anil Agarwal est connu comme étant le gérant d’un réseau de producteurs de matières premières via sa holding familiale Volcan. L’entreprise contrôle Vedanta Resources Plc, qui possède plusieurs filiales dont Hindustan Zinc.

Plusieurs analystes ont expliqué les investissements du milliardaire indien dans Anglo American par une volonté de contrôler l’entreprise et de la pousser à procéder à une scission, en séparant ses actifs sud-africains de ceux étrangers, assertions qu’il a toujours démenties.