Une consolidation sur 0.10/0.11 serait permettrait donc certainement aux cours de souffler ,

reprendre des forces en attendant le squeeze entre MM 150 semaines et MM20 semaines. C’est cette

MM à 20 semaines qui doit constituer votre stop loss à court terme.

Sinon a moyen terme on se trouve dans un triangle descendant de support 0,06 et de résistance le

trend haussier long terme en rouge à 0,14 actuellement.

La cassure de ce trend haussier serait très importante pour la suite, puisque cela permettrait

très certainement dans un premier lieu de refermer le gap des 0,19 euros et certainement d’aller

chercher les 0.23 euros

Oxi international est donc à suivre avec intérêt

La sortie d'un squeeze est toujours très intéressant à suivre, comme le chasseur à la sortie

d'un terrier !

Belle déclaration de Tony Caltado :

13/10/2009 à 21:46

En examinant le financement et les perspectives de la Société, Président et CEO Tony Cataldo a

déclaré: "OXIS a longtemps été connu pour sa science unique et brevetée. Nous commençons

maintenant notre transition d'une société avec une forte propriété intellectuelle (PI) à une

société de produits multiples dans des canaux sélectifs. Ce nouveau financement auprès

d'investisseurs stratégiques, dirigé par le théorème Capital, LLC, va nous permettre de

commencer notre transition vers le marché des produits de consommation. Nos efforts seront axés

sur des produits de haute qualité en profitant de l'adresse IP qui OXIS a développé pendant ses

45 ans d'existence.

FAUT ACHETER OXIS A QUEL COUR

J'avais acheter il y a un an a 0,04 et venduA 0,14

http://www.euroinvestor.co.uk/news/story.aspx?id=10667220&bw=20091012005307

OXIS International, Inc. Announces Sale of $2.0 Million in Convertible Debt

October 12, 2009 08:30 AM Eastern Daylight Time

BEVERLY HILLS, Calif.--(BUSINESS WIRE)--OXIS INTERNATIONAL, INC. (OXIS:PK) announced today that the

Company has entered into and closed agreements with several accredited investors to purchase

Convertible Debentures and Warrants representing $2.0 million in gross proceeds.

In connection with the current financing, the Company has issued 0% Convertible Debentures

convertible into shares of the Company’s common stock at a per share conversion price equal to

$0.05 per share. In addition, the Company has granted the purchasers Series A Warrants and Series B

Warrants each with the right to purchase shares equal to 50% of the principal amount invested by

each investor (the “Class A and Class B Warrants”) . The Class A and Class B Warrants are

exercisable for up to five years from the date of issuance at a per share exercise price of $0.0625

and $0.075, respectively, on a cash or cashless basis. Full exercise of the Class A and Class B

Warrants would result in 40,000,000 additional shares being issued. Collectively, the Debentures and

Warrants are referred herein as the “October 2009 Securities”.

The Company and its October 2009 Investors have agreed to place the proceeds in escrow with the

funds being released monthly, subject to settlement with existing creditors, upon the Company and

the October 2009 Investors submitting a joint statement to the escrow agent requesting the release

of funds.

Furthermore, in connection with the October 2009 Securities sale by the Company, the Company and

Bristol Investment Fund, Ltd. (“Bristol”) entered into a Standstill and Forbearance Agreement

whereby Bristol agreed to refrain and forbear from exercising certain rights and remedies with

respect to an earlier October 2006 financing and subsequent demand notes (the “Bridge Notes”)

issued by the Company in 2008 and 2009. Full details regarding the Bristol Agreement are disclosed

in the Form 8K filed on October 9, 2009 and earlier filings with the Securities and Exchange

Commission.

The current October 2009 Investors will have full ratchet anti-dilution protection and, if the event

of a subsequent financing, the October 2009 Investors may elect, in their own discretion, to

exchange all or some of the October 2009 Debentures (but not the Warrants) for any securities or

units issued on a dollar-for-dollar basis or to have any particular provisions of the subsequent

financing legal documents apply to the documents utilized for the October 2009 Financing.

The October 2009 Investors will have piggyback registration rights in the event that the Company

shall determine to prepare and file with the Securities and Exchange Commission a registration

statement relating to an offering for its own account or the account of others.

In discussing the financing and outlook for the Company, Chairman and CEO Tony Cataldo stated,

“OXIS has long been known for its unique and patented science. We are now beginning our transition

from a company with strong Intellectual Property (IP) to a company with multiple products in

selective channels. This new financing from strategic investors, led by Theorem Capital, LLC, will

allow us to begin our transition into the consumer products marketplace. Our efforts will be focused

on high quality products taking advantage of the IP that Oxis has developed during its 45 year

life.”

Please refer to the Form 8K filing for additional information as to the financing or contact the

Company at: 310-860-5184. For additional information about OXIS, please visit our web site:

www.oxis.com.

Forward-Looking Statement

Statements about the expected future prospects of our business, statements about our outlook for

internal revenue growth, and all other statements in this release other than historical facts,

constitute forward-looking statements. You can identify forward-looking statements because they

contain words such as "believes," "expects," "may," "will," "would," "should,"

"seeks," "approximately," "intends," "plans," "estimates," or "anticipates" or similar

expressions which concern our strategy, plans or intentions. All statements we make relating to

estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and

financial results are forward-looking statements. In addition, we, through our senior management,

from time to time make forward-looking public statements concerning our expected future operations

and performance and other developments. All of these forward-looking statements are subject to risks

and uncertainties that may change at any time, and, therefore, our actual results may differ

materially from those we expected. We derive most of our forward-looking statements from our

operating budgets and forecasts, which are based upon many detailed assumptions. While we believe

that our assumptions are reasonable, we caution that it is very difficult to predict the impact of

known factors, and, of course, it is impossible for us to anticipate all factors that could affect

our actual results. Some of the factors that we believe could affect our results include:

commercialization of our products, the impact of the difficult economic climate on our potential

customer base and their ability to pay on time and engage us for new products, the difficult

conditions in the nutraceutical products industries, the effect of governmental regulation on the

Company and other factors described from time to time in our filings with the Securities and

Exchange Commission. The factors described in this paragraph and other factors may affect our

business or future financial results. We assume no obligation to update any written or oral

forward-looking statement made by us or on our behalf as a result of new information, future events

or other factors.

About OXIS International, Inc.

OXIS International, Inc. focuses on the research, development and marketing of nutraceutical

products in the field of oxidative stress reduction. Many of our planned nutraceutical products

include L-Ergothioneine (“ERGO”) as a component. The Company holds patents and patent

applications for the protective effect of ERGO on mitochondria, the commercial preparation process

and the neuroprotective effects of ERGO. OXIS believes that there is a high potential to sell ERGO

as a food supplement or in the form of tablets and is pursuing this avenue of sales and distribution

of ERGO.

Auj. à 16:39

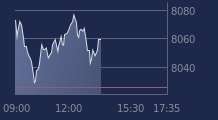

(Tradingsat.com) - Oxis International, société américaine spécialisée dans le développement de

technologies destinées à la prévention et au traitement des maladies associées au stress

oxydatif, voit son cours de Bourse s'envoler de 31% à 17 centimes dans des volumes d'échange

monstrueux sur le compartiment C de l'Eurolist : plus de 7,7 millions de titres ont d'ores et

déjà changé de mains à 16 heures, soit plus de... 110% du capital !

Même chose sur le marché américain Pink Sheet où la valeur est cotée et s'envole de 28% à

0,23 dollar dans des volumes déjà importants de 136 400 titres en quelques minutes, contre une

moyenne de 51 600 titres sur les trois derniers mois.

Oxis International vient d'annoncer la conclusion d'accords avec plusieurs investisseurs en vue

d'émettre en leur faveur des obligations convertibles et des bons pour un montant de 2 millions de

dollars.

Présentant les perspectives de la société, Tony Cataldo, le directeur général d'Oxis rappelle

qu'Oxis est connue depuis longtemps pour sa « science unique et brevetée ». D'une société à

forte propriété intellectuelle, Oxis International souhaite à présent évoluer vers les produits

de consommation grâce à ce financement obtenu auprès d'investisseurs stratégiques.

Copyright (c) 2006-2009 Tradingsat.com. Tous droits réservés.

J'ai du mal à estimer cette news sur la valorisation de la société. C'est sur que c'est très

positif mais peut on voir un cours à 1 euro à court terme ?

T'avais raison titi j'ai vendu trop tot et aurais du t'ecouter ce matin

quand tu aura d'autre ocasion tu fera signe

Bravo, pour l'info

C'est énorme.

TEQUILA20a écrit : Bravo, pour l'info

C'est énorme.Je vous avais dit que Titi est très bon, c'est pas un déconneur !

chapeau titi t'as degoté une mine d'or un up de 92 pour cent en une journée